The Hidden Edge Behind Great Businesses

PRESENTED BY SNOWBALL ANALYTICS

Disclaimer: This page contains some affiliate links that might just lead you to the promised land of awesomeness (or at least some cool products). I personally use all of the products promoted, and recommend them because they are companies I have found to be helpful and trustworthy. I may receive commissions for purchases made through links in this post.

I recently started reading The Compounder’s Element by Laurence Endersen. I’m only about halfway through the book, but so far, I like it.

One chapter in particular has really stood out to me. In it, Endersen talks about what he calls SATBs, which stand for Structurally Advantaged Business Models. He writes:

“Some business models are simply better than others. There is something intrinsic to the nature of the business model itself, that, all else being equal, is a source of advantage. These businesses are durable by design.”

He covers 10 different SATBs in the chapter, but there were a handful that really jumped out to me, and I want to go through a few of them with you today.

1 - “High ROIC Cookie Cutter”

Endersen points out that the ability to reliably reinvest free cash flow at a high return on invested capital (ROIC) is a huge structural advantage. And he’s not the only one who thinks so.

In What I Learned About Investing From Darwin, Pulak Prasad makes the case that looking at returns on capital is one of the best and fastest ways to filter for high-quality businesses. There are a few reasons for that.

First, a good investment filter should be measurable, and ROIC is just that. It’s a concrete financial metric you can calculate and track.

Second, because ROIC measures how much a company earns on the capital it puts to work, it weeds out businesses with bad economics. That alone narrows the universe to a much higher-quality batch of companies.

And third, a high ROIC can be a sign of a durable competitive advantage. Businesses with strong pricing power, network effects, or other strengths tend to keep generating those high returns year after year.

Source: Snapstock

Take Visa (V), for example. They’ve consistently put up an ROIC above 20%—and it’s been trending higher as time goes on.

A high ROIC also tells us that management is doing a great job of finding places to put capital to work. And since capital allocation ultimately comes down to management decisions, a high ROIC can be a sign of an above-average management team.

2 - “Privileged Perch”

This one’s about businesses that have limited competition because they’re protected by things like legal, regulatory, or reputational barriers.

Things like patents, for example, give a company monopoly-like control over a product for a set amount of time. This type of advantage is commonly found in the pharmaceutical world, where drug manufacturing often comes with periods of exclusivity that work pretty much the same way.

Looking at AbbVie (ABBV), two of their biggest growth-driving drugs right now are Skyrizi and Rinvoq. AbbVie has the exclusive rights to sell them until 2031 and 2033, respectively, which basically means nobody else can touch those drugs until then.

Source: Seeking Alpha

That exclusivity has fueled explosive sales growth for both products, and it should continue right up until the exclusivity expires. After that, generics will step in—just like what happened with Humira. But until then, AbbVie gets to reap the full benefit.

3 - “Stuck On You” (AKA High Switching Costs)

Keeping customers is usually way more profitable than constantly chasing new ones, and businesses that make it hard for customers to leave have a built-in edge. Sometimes that comes down to money, but more often it’s about time, integration, or trust.

Think about a platform you’ve been using for years. You know it inside and out, and you’ve already sunk hours (or maybe years) into getting it set up. In some cases, you’ve even built your whole workflow around it.

Adobe Premiere is a personal example of that for me. I’ve been using it to edit my videos for almost a decade, so it’s like second-nature to me at this point.

Even if there’s a cheaper alternative out there—which there is—the thought of starting from scratch with a new software is so unappealing to me that I have no interest in changing. That’s what makes switching costs such a powerful advantage.

In the dividend-paying world, Verisk (VRSK) is another good example of a company that tends to have sticky customers.

I mentioned it in a recent video, but in short: Verisk provides data to insurance companies that they use for underwriting and risk assessment. That data is deeply embedded in their operations, and insurers rely on it when making multibillion-dollar decisions.

On top of that, Verisk runs on a subscription model, which means they’re also generating recurring revenue. Put all those things together, and you’ve got a very advantageous business that’s been growing consistently for years.

Source: Snapstock

With all of that said, the businesses you own should ideally fit into at least one of these SATB buckets. Endersen argues that these businesses are more likely to outperform over the long run, and I’d have to agree.

Do you own any businesses that possess one of these SATBs? Write to me here and let me know.

Dividend Investing Democratized

Join thousands of savvy investors in the pursuit of early retirement. Get Retire With Ryne delivered straight to your inbox every week as you build your perpetually growing, cash-flowing dividend stock portfolio.

One of the most essential tools for any investor is a reliable portfolio tracker, and Snowball Analytics is the ultimate command center for your portfolio, providing all the tools you need (and more) in one place.

Plus, it’s one of the only portfolio trackers out there designed specifically for dividend investors.

The layout is clean and intuitive, offering charts, graphs, and other features you didn’t even know you needed but now can’t live without—like the event calendar, portfolio backtest tool, and the dip finder tool (this has been a game changer).

I’ve been using Snowball for a while now, and it's the most in-depth portfolio tracker I’ve ever used (you can see it in action here). I highly recommend it to any dividend investor looking for maximum functionality and data for tracking their portfolio.

Right now, Snowball Analytics is offering a 14-day FREE trial so you can try it out risk-free. The best part is, if you end up loving it (which, as you'll find out, is not hard to do), you can save 10% on your subscription when you use code “rynewilliams” upon signing up.

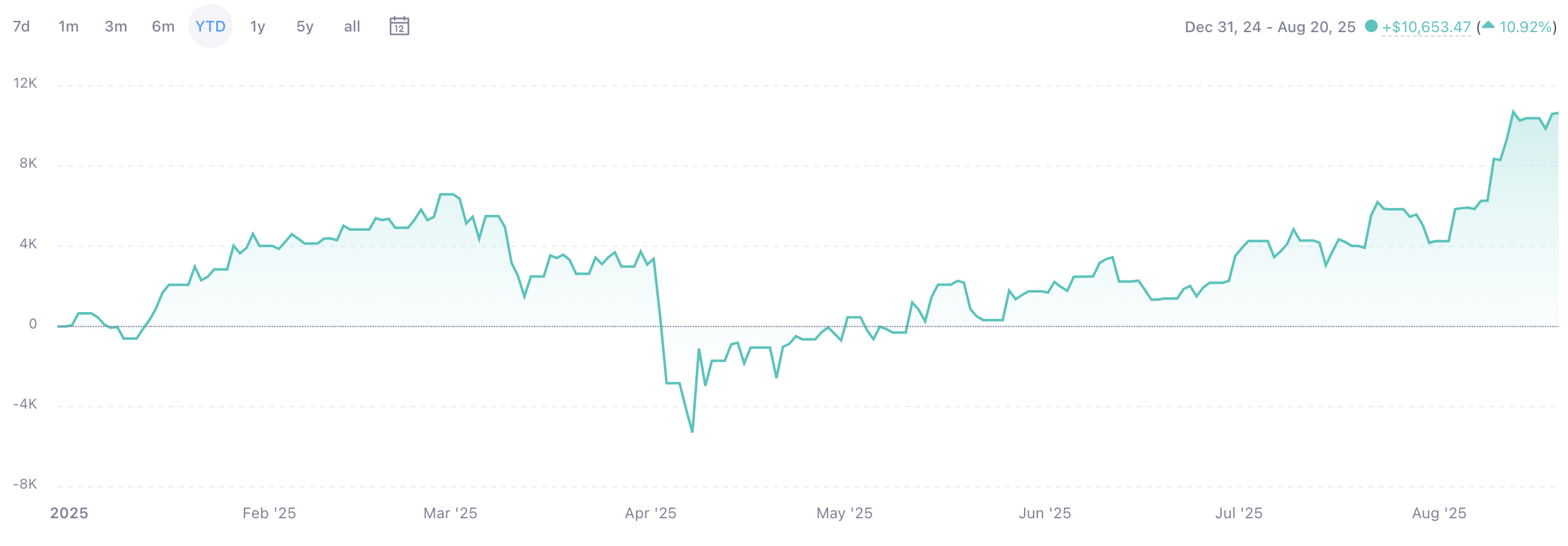

IN MY PORTFOLIO 📈

Start tracking your portfolio with Snowball Analytics today—free for 14 days! Plus, use code "rynewilliams" at checkout to get 10% off your subscription.

ICYMI 🎥

This Is How To Find the PERFECT Balance In Your Portfolio | Ep. 32

In this episode of The Deep End, we are joined by Brandon Beavis, co-founder and CMO at Blossom Social.

CAREFULLY CURATED 🔍

📺 SCHD Is Dead? - After a multi-month trip across Europe, Jake from Dividend Growth Investing is back with a bang, breaking down why investors are unhappy with SCHD, why it’s been underperforming, and what he thinks about it all.

🎧 Breaking Bread With A Buffett Expert - My main man Russ sits down with Alex Morris, author of Buffett and Munger Unscripted, to talk about what he learned after analyzing 30 years of Berkshire Hathaway annual meetings.

📚 Very Bad Advice - When you’re trying to get ahead in life, it can help to flip things around and focus on what not to do. Morgan Housel’s latest blog post offers a solid list of things to avoid.

SINCE YOU ASKED 💬

"What is the advantage of buying a stock with a high price but a low dividend yield, like Visa?"

- Matt W. | YouTube

This is a fantastic question, and it's one that I get all the time.

As a dividend investor, people are often surprised that I’d want to own a stock like Visa (V). The dividend yield is less than 1%, so on the surface, it doesn’t seem to make sense. If dividend income is what you're after, why buy something that pays so little?

And it’s true—right out of the gate, you won't be generating much income from Visa. But it's important to remember that there’s more to investing in stocks than just looking at the dividend yield.

After all, a stock isn’t just some three-letter thing on a screen that randomly goes up and down, and a dividend isn't just a random payment that shows up in your account every quarter. A share of stock represents ownership in a living, breathing business, and a dividend is your share of that business's profits.

With that in mind, my ultimate goal is to own great businesses that I can hold for a long time. Dividends aside, I think that’s the real advantage of a company like Visa.

It's not the starting dividend income it provides, but the quality of the business itself. Over time, I believe it will leave me with more wealth (and more cash flow) than I started with.

It’s also worth noting that even though the yield is low, Visa has historically been a fantastic dividend grower. Over the last five years, they’ve increased their dividend by more than 15% on average—and the growth rate is even higher if you look back over the last decade.

That means your income can grow quickly just by holding the stock. And the only reason they can raise the dividend so aggressively is because their sales, earnings, and free cash flow keep growing too.

So while Visa's strengths don't necessarily show up in the starting yield, they will show up in your growing dividend income over time—and, more than likely, in your total returns as well. That’s why I’m happy to own Visa, even as a dividend investor.

Have a question? Ask me here to see it featured in an upcoming newsletter.

LAST WORD 👋

Over the past few weeks, I’ve started posting these short portfolio review videos on TikTok and YouTube (and all my social platforms, really). Basically, I’m reviewing portfolios from investors who have accounts on Blossom.

I’m putting these out almost every day, so if you’d like me to review your portfolio, all you have to do is set up a Blossom account and then send me a message with your username, or just tag me in a post.

It’s a fun way for us to connect, and it gives me a chance to share some personalized insights on your holdings.