Master Your Dividend Domain

Right now, we're living in what I call "The Golden Age of Investing."

We have an endless supply of information and resources at our fingertips that we can access for free, making the barrier to entry for investing lower than it's ever been.

The pursuit of Financial Freedom is no longer an exclusive privilege. Instead, it is an empowering and exciting endeavor available to all.

While this has its perks, all of this readily-available information can simultaneously be a double-edged sword.

We've become bombarded with an avalanche of stock tips and analyses from all sorts of sources, making it tempting to surrender your investment choices to the wisdom of the crowd. In doing so, you risk losing the essence of what it truly means to be the "Master of Your Domain."

The ability to think for yourself and make your own decisions is paramount as an investor. This is not to say that you should completely ignore the insights of others and not learn from more experienced investors, but blindly following the herd can lead to a lack of control over your portfolio and your financial future.

As the saying goes, "Too many cooks spoil the broth." Similarly, too many opinions can muddy the waters and cloud your judgment.

So, how can you maintain your position as "Lord of the Manor" and become the master of your dividend domain? Let's explore a few essential principles that can help you navigate this, and can help ensure that you maintain autonomy over your portfolio.

Distinguish Between Fact and Inference: While it's helpful to gather data and hear varying viewpoints on different companies, it's especially important to differentiate between what is fact and what is merely an opinion. Treat ALL of the YouTube videos you watch and the articles you read as a collection of opinions and ideas rather than gospel truths.

Conduct Your Own Due Diligence: Becoming a master of your dividend domain means taking the time to do your own research (and furthermore, learning how to do your own research). Don't simply rely on the recommendations of others without understanding the reasons behind those inferences.

Dive into financial statements, analyze a company's fundamentals, study its historical performance, and allow yourself ample time to process all of this information (because it's a lot!). When you sharpen your investing skillset, you'll be better equipped to make informed choices that make sense in your portfolio.

If you don't want to learn how to do all of that, and are looking for something more hands-off and automated, then thank goodness for ETFs — I've ranked the top 10 dividend ETFs from best to worst for you here.

Define Your Investment Strategy: It's important to remember that investing is a highly personal endeavor (that's why they call it personal finance), and what works for someone else may not work for you. Consider factors like your time horizon, income needs, and risk appetite when choosing investments for your portfolio.

Remember, you don't need to conform to any stock or strategy if it doesn't align with your long-term goals.

I've found that it helps to write these down, and I've even gone so far as to write out my entire investment philosophy. I'm still fine-tuning the details, but I will absolutely share it with you when I'm finished.

Embrace Your Mistakes: Becoming the master of your dividend domain involves taking ownership of your investment decisions, even when they don't go as planned. If you put money into a failed investment that your favorite finance creator was incessantly hyping up, at the end of the day, it's still you who decides how to allocate the funds in your portfolio.

We all make mistakes, and the key is to learn from them. Instead of blaming others or blindly following their advice, consider these mistakes your cost of tuition in the school of hard knocks (as my friend Ari Gutman would say), and look at them as opportunities for growth and improvement.

Being the master of your domain means taking control of your investment decisions and having the confidence to think for yourself. This is true in both investing and in life.

Remember, your financial future depends on the choices you make, and embracing the responsibility to chart your own course can lead to a more rewarding and fulfilling dividend investing journey.

With that said, I want to hear from you: Are you the master of your domain? If not, what can you do to enhance your mastery? Write to me here and let me know.

And a big thank you to the 27 readers who responded to last week's newsletter. I really enjoyed reading about your highest dividend payments ever. You guys are crushing it! 👏

Dividend Investing Democratized

Join thousands of savvy investors in the pursuit of early retirement. Get Retire With Ryne delivered straight to your inbox every week as you build your perpetually growing, cash-flowing dividend stock portfolio.

PRESENTED BY THE DIVIDEND TRACKER

While I love my dividend portfolio tracking spreadsheet (see the "In My Portfolio" section), its functionality is pretty limited compared to what you'll receive from The Dividend Tracker.

The Dividend Tracker truly is a one-stop shop for dividend investors and offers a full suite of portfolio tracking and stock research tools. Among these, the feature I find myself using the most is the Payout Calendar, which shows you when you're getting paid, how much, and from which companies. I also use the platform pretty heavily for stock analysis, and like to compare/contrast my findings with those from Seeking Alpha.

In my opinion, The Dividend Tracker takes the best parts of both my dividend portfolio tracking spreadsheet and Seeking Alpha, and rolls them into one platform to offer investors a unified and refined experience.

While certain premium features do require a subscription, the free version of The Dividend Tracker still provides substantial value and is worth checking out if you're in need of something more in-depth than a spreadsheet to track your portfolio.

IN MY PORTFOLIO

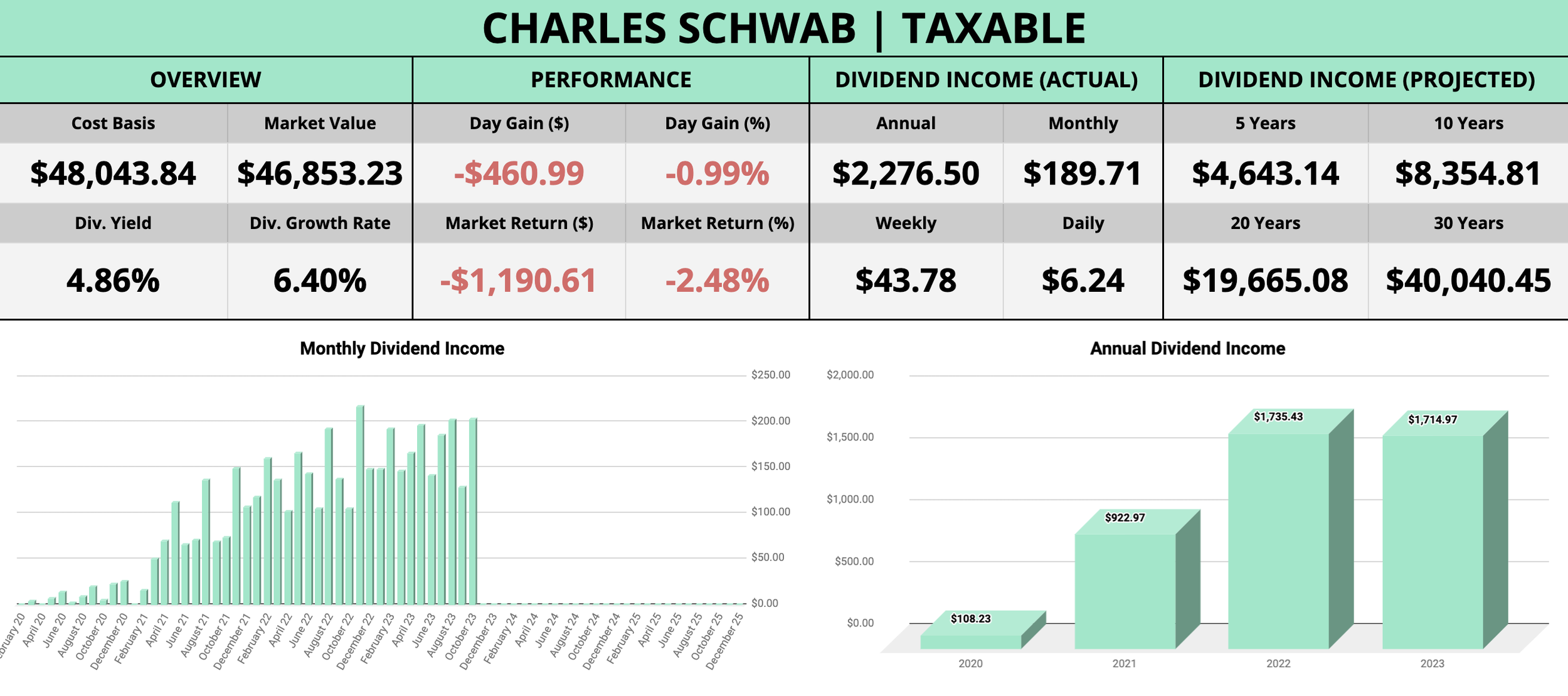

Want to get my Dividend Portfolio Tracking Spreadsheet? Click here to get it for free.

ICYMI

3 Deeply DISCOUNTED Dividend Stocks To Buy In November 2023

The end of October marks the end of another (mostly) red month on the market. With that, there are an abundance of discounted stocks out there to choose from, three of which I'm honing in on in this video as my personal favorites heading into November.

All three of these stocks are currently priced at a bargain and look like prime pickups for your portfolio right now. In fact, I'm putting my money where my mouth is with one of these stocks, and am actively adding more to my portfolio!

CAREFULLY CURATED

📺 Over $100,000 Invested In One ETF - Lanny, who represents one half of the Dividend Diplomats, just hit a huge milestone in his portfolio: $100,000 invested in one ETF. Just from this one fund, Lanny is bringing in over $320 every single month, and hearing him talk about this impressive feat really lit a fire in me. I think you will really enjoy this video, and I hope it motivates you just as much as it did me.

🎧 Why Dividends Are Better Than Your 9-5 Income - There are countless reasons why I love dividends, and every day I day-dream about having enough passive income to pay all of my bills. I'm guessing that you feel the same way, and because of that, this episode of the Dividend Talk podcast will be right up your alley. In it, they talk about all of the benefits of dividend income versus the regular income from your job, and how dividends can be a powerful wealth-building tool that grows even faster than your salary.

📚 Five 8%-Yielding Blue Chip Stocks - The factors that determine which direction share prices will move are impossible to predict. In investing, there is so much that is outside of your control, and that can be a discomforting thought to sit with. All you can do is try and invest in companies that are well-equipped to weather the changing tides in the market, and the five high-yield dividend stocks highlighted in this article are excellent choices for exactly that.

SINCE YOU ASKED

"Hey Ryne, I am looking for some advice. I'm only 24 and I've been putting money into SCHD in a Roth. However, I'm starting to wonder if I'm too young to be locking this money up for such a long time inside of a Roth. What are your thoughts?"

- @nathans5782 | YouTube

This is a fantastic question. Many people will argue that you should always prioritize contributing to your tax-advantaged retirement accounts (like a Roth IRA) over your regular, taxable brokerage account. I think many people can be dogmatic about that, but I don't think it's so black-and-white.

While I do believe the tax benefits of something like a Roth IRA (which you can learn about here) are too important to completely pass up, how much priority you place on this account over your taxable account depends on when you plan to start living off of your investments.

In my opinion, if you're hoping to actually use the money generated from your investments long before the penalty-free withdrawal age (59.5 years old), then prioritizing a taxable account that offers the flexibility to do so may make sense. However, if you're planning on a more traditional career path, and plan to "retire" later than sooner, then I don't think you have anything to lose by focusing more on your Roth IRA and getting that maxed out every year.

Have a question? Ask me here to see it featured in an upcoming newsletter.

Disclaimer: This page contains some affiliate links that might just lead you to the promised land of awesomeness (or at least some cool products). We may receive commissions for purchases made through links in this post. It's nothing fancy, but it certainly does the job!