$100,000 Later: My Biggest Investing Lesson So Far

Disclaimer: This page contains some affiliate links that might just lead you to the promised land of awesomeness (or at least some cool products). I personally use all of the products promoted, and recommend them because they are companies I have found to be helpful and trustworthy. I may receive commissions for purchases made through links in this post.

As a lot of you already know, I just hit a pretty big milestone in my portfolio (check out the big portfolio reveal here).

After five years of contributing to my portfolio every single week and reinvesting every single dividend, I finally crossed the $100,000 mark. It took me long enough, I know.

The climb from $50k to $95k felt like it happened in a flash. Two years ago, I was sitting at $53k, and I was at $75k a year later. Things were moving pretty fast.

But once I got near $95k, I found myself stuck in some sort of investing limbo. I kept hovering between $95k and $99k, which was frustrating. And after a while, that elusive final push seemed like it was never going to come.

But then, out of nowhere, it happened.

One random day last week, I got back from a run and saw a bunch of market notifications. SCHD was up 2%. Dividend stocks, in general, were flying.

I opened up Snowball Analytics to see that, lo and behold, the ceiling had finally shattered. My portfolio had officially crossed $100,000 for the very first time!

I can’t tell you how excited I was to see that number. It had been a long time coming.

Over the course of your investing journey, you hit a lot of cool milestones, but some of them feel undeniably bigger than others. Your first $10k, your first $100 month in dividends, hitting $50k—these are all pretty meaningful.

But $100,000…this one felt different for some reason. I think that’s because—as Charlie Munger said—it’s the hardest one to reach, but it’s also the most important.

I talked in-depth about that in this video here, but once you hit $100,000, the compounding effect in your portfolio really starts to become more noticeable. Once you get there, your returns start to move the needle for you in a much bigger way, as opposed to your contributions doing most of the heavy lifting.

I think that’s why this milestone hits a bit harder than some of the others I’ve experienced. At the end of the day, $100,000 is just a nice, round number. So it’s not really about that, it’s more about what it represents.

To me, it represents five years of showing up and staying the course. Five years of staying focused on working towards a goal. Five years of doing something that didn’t always feel like it was paying off…until it did.

We’ll see if the “hard part” is actually behind me. But if $100,000 really is the hardest, then $200,000 should come a lot easier, and $400,000 even more than that.

And that’s the cool thing about compounding. It just gets better with time.

So if you’re still on your way to your first big milestone—whether that’s $10k, $50k, or $100k—keep going. Don’t worry about being perfect, just be consistent.

Before you know it, one day—on some random Tuesday—you’ll open your portfolio to find that you’ve finally hit that milestone. And when that day comes, you will be so glad you didn’t give up.

With that said, I’d love to hear from you: what milestone are you working toward in your portfolio right now? Write to me here and let me know.

Dividend Investing Democratized

Join thousands of savvy investors in the pursuit of early retirement. Get Retire With Ryne delivered straight to your inbox every week as you build your perpetually growing, cash-flowing dividend stock portfolio.

I use Seeking Alpha every single day, and have done so for years now. It's my go-to website for everything related to stock research, and it's been essential in helping me become a better investor.

Whether I'm looking up dividend stats, reading the news, listening to earnings calls, or just want to find out what others are saying about a particular stock, Seeking Alpha has it all (for free), and the Premium version is even better.

The Premium version gives you unlimited access to Seeking Alpha's library of articles, personalized portfolio tracking tools, and a ton of other essential features for the dedicated dividend investor. You can see the full list of Premium features here.

Right now, Seeking Alpha is offering a 7-Day FREE Trial of their Premium platform so you can try it out risk-free. The best part is, if you end up loving it (which if you're like me, you definitely will), you'll automatically get $30 OFF of your annual subscription.

It's normally $299 for the year, but with the discount it comes out to $269. I've been using it for years, and have definitely found it to be worth the money.

If nothing else, it's at least worth checking out the 7-Day FREE Trial.

IN MY PORTFOLIO 📈

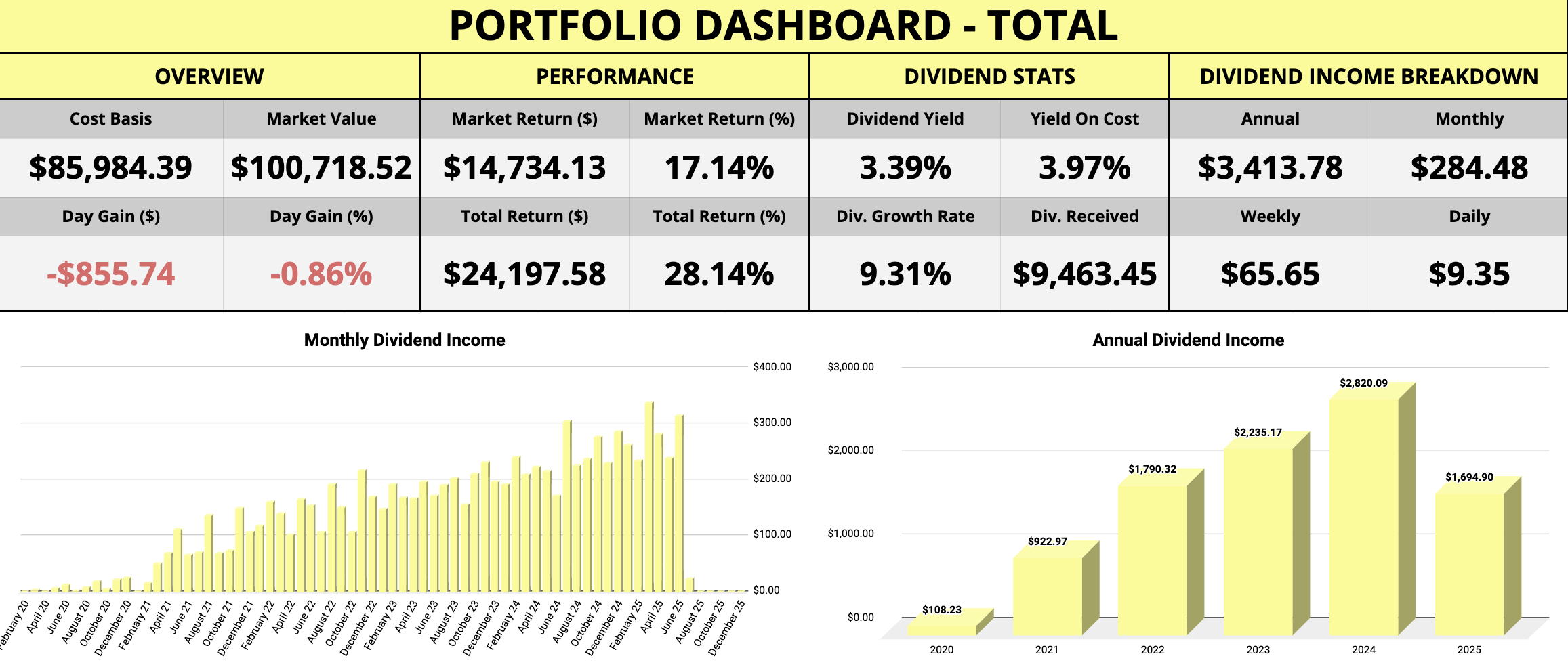

Portfolio performance provided by Snowball Analytics

ICYMI 🎥

All Our Dividend Income From June | Ep. 26

In this episode of The Deep End, we're breaking down all of our dividend income from the month of June and reflect on the portfolio milestones we’ve hit along the way.

CAREFULLY CURATED 🔍

📺 Betting On VICI - VICI Properties (VICI) is one of my favorite REITs, but is it a buy right now? Watch this video to find out what Dividendology has to say about it.

🎧 The Inner Game - This episode of The Art of Quality podcast with Chris Mayer dives into the inner game of investing. Chris shares how certain habits and routines have helped him stay level-headed, even during turbulent markets.

📚 Gardens, Not Machines - According to Paul Higgins, great businesses—like gardens—don’t thrive by following a strict, cookie-cutter playbook. They grow slowly, adapt to their environment, and let their core strengths take shape naturally over time.

SINCE YOU ASKED 💬

"Which strategy do you think is better: Maxing out a Roth IRA at the beginning of the year or dollar-cost averaging throughout the year?"

- Sysam07 | YouTube

This is a great question, and it really just depends on a couple of different factors.

First off, it depends on what the market does that year. If you maxed out your Roth IRA on January 1st—put the full $7,000 in right away—and the market ends the year on a good note, then doing it all at once would’ve worked out great.

But if the market ends the year down, you’ll probably wish you hadn’t gone all in at the start. In that case, dollar-cost averaging might’ve been the better move.

Like I said, it depends on what the market does—but more importantly, it depends on what makes the most sense for you personally.

If you’re the kind of person who likes to get it all done on day one and not think about it the rest of the year, then go for it. If you prefer the consistency of spreading it out—or only have the cash to invest a little at a time—then dollar-cost averaging is a great option too.

At the end of the day, like most things in investing and personal finance, it really comes down to personal preference. You can’t go wrong either way.

The most important thing is that you’re investing in the first place. As long as you’re doing that, you’re on the right path. Just make it work for you.

Have a question? Ask me here to see it featured in an upcoming newsletter.

LAST WORD 👋

Snapstock is officially live!

After months of work behind the scenes, Snapstock is no longer just a members-only tool—it’s now a full, standalone platform, and enrollment is open.

Until now, the only way to access Snapstock was through The Investment Club. But starting today, anyone can join!