My Top Dividend Stock To Buy In July

PRESENTED BY SNOWBALL ANALYTICS

Disclaimer: This page contains some affiliate links that might just lead you to the promised land of awesomeness (or at least some cool products). I personally use all of the products promoted, and recommend them because they are companies I have found to be helpful and trustworthy. I may receive commissions for purchases made through links in this post.

We still have a few more days before the month officially ends, but June so far has been kind of a mixed bag.

The market itself is up about 2.5%, so a decent amount of action there. But beneath the surface, there’s been plenty of movement in both directions—and we’re starting to see some really solid dividend stock discounts rise to the surface.

One of those names is a company I found out about not too long ago from my friend Lanny of The Dividend Diplomats. We’re talking about PACCAR (PCAR), which is a very under-the-radar business—and my top dividend stock to buy in July (you can learn about some of my other top picks here).

You might not be familiar with the name unless you’re deep in the weeds of the commercial trucking industry, but you’ve most definitely seen their products out on the road. PACCAR is the company behind Kenworth, Peterbilt, and DAF—three of the most respected names in commercial trucks.

These are premium vehicles known for their quality, durability, and cutting-edge technology—and they’ve built a strong, loyal customer base over the years. But what makes PACCAR stand out to me isn’t just the trucks themselves—or the fact that many in the industry aspire to own them—it’s the business model behind them.

Every truck PACCAR sells opens the door to two more recurring revenue streams: one from replacement parts and another from financing. So when someone buys a Peterbilt, PACCAR doesn’t just make money from the sale—they also continue to earn income when that customer needs to finance the truck or order new parts down the road.

Even though their trucks are far from cheap (they’re actually considered a premium product), PACCAR has created a kind of razor-and-blade business model. And that model is applied to an industry that’s absolutely vital to the global economy.

Here in the U.S., trucks move nearly 72% of all freight. That means a huge majority of the supply chain depends on vehicles like the ones PACCAR produces.

Still, despite how strong and essential the underlying business is, the stock has been under a lot of pressure lately. As I’m writing this, shares are down about 12.7% year to date and 11% over the past twelve months. And from what I can tell, most of this is earnings-related.

Back in April, PACCAR reported Q1 2025 earnings that fell short in a few key areas. Non-GAAP EPS came in at $1.46, missing estimates by $0.12. And even though revenue beat expectations by about $350 million, it still represented a nearly 15% decline compared to the same time last year.

In the release, management pointed to ongoing tariff uncertainty and broader economic concerns as the main drivers of the missed earnings. And I think it’s safe to say those headwinds will probably stick around for the time being.

However, moments like these are when we long-term investors need to take a step back and remind ourselves why we invest in the first place. We’re shareholders—not shareflippers.

And if you’re thinking like a shareholder, you’ll understand that short-term turbulence doesn’t always translate to long-term trouble. In PACCAR’s case, this is a company whose long-term trajectory has only gotten stronger.

Over the last five years, revenue has compounded at nearly 16% per year. EPS is up more than 33% annually, and free cash flow per share has grown at over 20%. Not too shabby for what most people would write off as just a boring trucking business.

Source: Snapstock

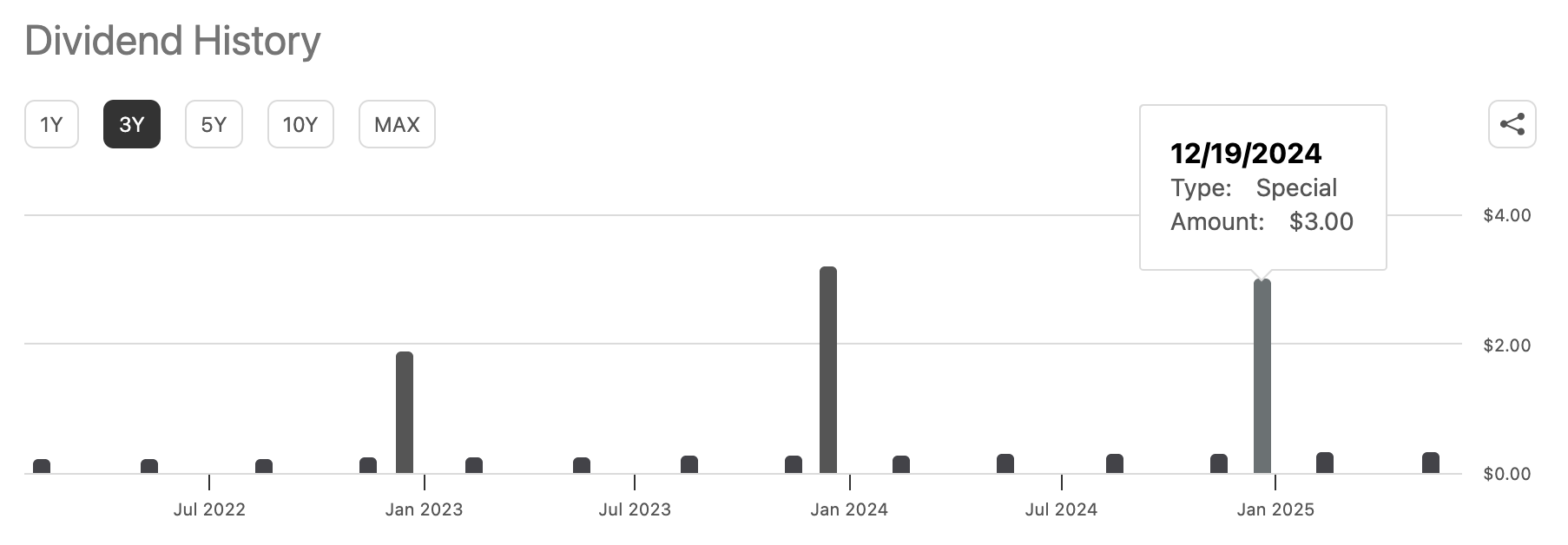

PACCAR’s dividend history is just as impressive. The company has paid a dividend every single year since 1941—more than 80 years of uninterrupted payouts!

But what makes their dividend even more exciting is the fact that they regularly issue special dividends on top of their quarterly payments, which is something very few companies do.

Source: Seeking Alpha

At today’s prices, you can lock in a 4.25% dividend yield, which is slightly above the company’s 10-year average yield of 3.9%. And over time, the dividend has grown at a mid-to-high single-digit pace—a solid pairing with the already-high starting yield.

Source: Snapstock

All in all, PACCAR isn’t the sexiest company on the market, but it’s exactly the kind of business I’m interested in: high quality, dividend paying, and built to last. I just added this one to my watchlist and plan to keep a closer eye on it from here.

With that said, PACCAR isn’t the only good buying opportunity on the market right now. It looks like there are quite a handful more, and I want to hear from you: Which discounted stocks do you have your eye on as we fly into July? Write to me here and let me know.

Dividend Investing Democratized

Join thousands of savvy investors in the pursuit of early retirement. Get Retire With Ryne delivered straight to your inbox every week as you build your perpetually growing, cash-flowing dividend stock portfolio.

One of the most essential tools for any investor is a reliable portfolio tracker, and Snowball Analytics is the ultimate command center for your portfolio, providing all the tools you need (and more) in one place.

Plus, it’s one of the only portfolio trackers out there designed specifically for dividend investors.

The layout is clean and intuitive, offering charts, graphs, and other features you didn’t even know you needed but now can’t live without—like the event calendar, portfolio backtest tool, and the dip finder tool (this has been a game changer).

I’ve been using Snowball for a while now, and it's the most in-depth portfolio tracker I’ve ever used (you can see it in action here). I highly recommend it to any dividend investor looking for maximum functionality and data for tracking their portfolio.

Right now, Snowball Analytics is offering a 14-day FREE trial so you can try it out risk-free. The best part is, if you end up loving it (which, as you'll find out, is not hard to do), you can save 10% on your subscription when you use code “rynewilliams” upon signing up.

IN MY PORTFOLIO 📈

Start tracking your portfolio with Snowball Analytics today—free for 14 days! Plus, use code "rynewilliams" at checkout to get 10% off your subscription.

ICYMI 🎥

The Real Reason Stocks Fall | Ep. 24

In this episode of The Deep End, we unpack the real reason stocks fall—and why it often has nothing to do with the earnings, dividends, or anything else related to the business.

CAREFULLY CURATED 🔍

📺 High-Yield Horror - Dividend Bull is fed up with websites like the Motley Fool and Seeking Alpha continuing to recommend these high-yielding stocks despite their terrible track records.

🎧 All About AmEx - A deep dive into American Express, brought to you by the Investing For Beginners podcast.

📚 When Total Return Isn't - Daniel Peris, author of The Ownership Dividend, argues that it’s time to rethink how we measure stock market performance—and why you might want to leave unrealized capital gains out of your sense of wealth.

SINCE YOU ASKED 💬

"What are your thoughts on holding competing stocks within a certain sector? For example, HD and LOW. Is it redundant to hold both?"

- iBRuss23 | YouTube

This is a great question! I'll probably do a full video talking about this at some point, but here are some quick thoughts.

Yes, I do think it’s a bit redundant to own two companies that essentially do the same thing in the same industry. Home Depot and Lowe’s are a great example, and so are Visa and Mastercard.

In both cases, the business models are practically identical, they target the same customers, and they're both affected by the same things. So if one of them is doing well, chances are the other one is too—and if one’s struggling, the other probably isn’t far behind.

With that said, it's also not the end of the world if you own both. It won’t ruin your portfolio or anything.

But it does beg the question: what’s the benefit of owning both? If these businesses are so similar, and you feel good about making a judgment call, I think it makes more sense to just own the one you think is slightly better—whether that’s based on valuation, growth prospects, dividend stats, or something else.

Have a question? Ask me here to see it featured in an upcoming newsletter.