I Just Sold My Favorite Dividend Stock

Disclaimer: This page contains some affiliate links that might just lead you to the promised land of awesomeness (or at least some cool products). I personally use all of the products promoted, and recommend them because they are companies I have found to be helpful and trustworthy. I may receive commissions for purchases made through links in this post.

Well, I never thought I’d be saying this, but after more than five years of being a shareholder, I just sold out of one of my favorite dividend stocks of all time—Starbucks (SBUX).

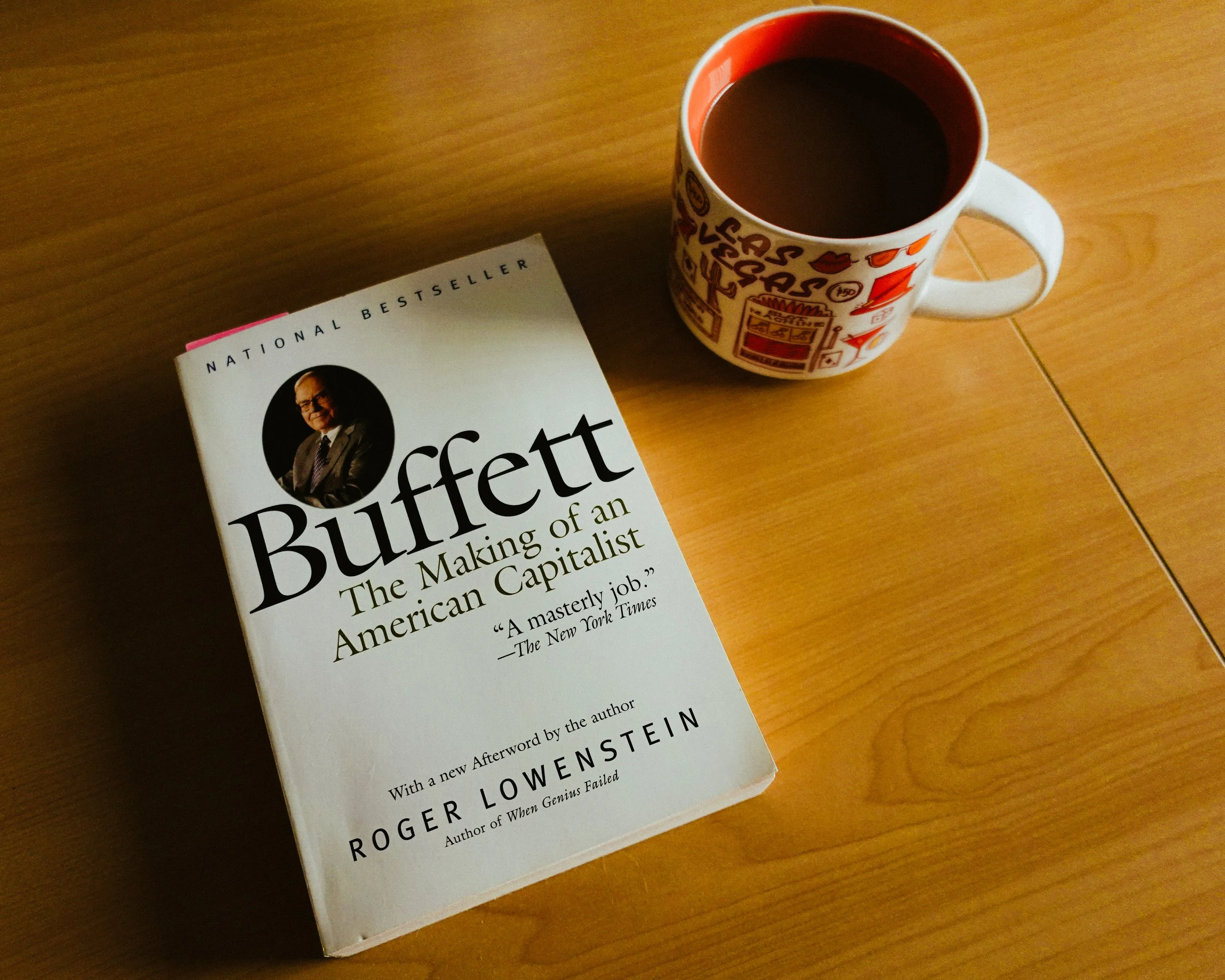

This one wasn’t easy—I’ve always had a soft spot for Starbucks. I drink their coffee every day (we buy the beans for home), and without exception, sip it out of the Las Vegas mug from their “Been There” series. That, plus a good book, is my favorite way to start the day.

When I first bought into Starbucks, which I did as a brand-new investor back in 2020, I thought I was picking up one of the coolest dividend growers out there. It has a global brand with what seemed like strong pricing power (though their increasingly high prices are one of the things many customers don’t like about them), a loyal customer base, and an incredibly simple business model.

At the time, they had been raising the dividend for just over a decade, and the underlying business was strong enough to support it. The margins had been historically solid, the return on invested capital was high, and free cash flow had been trending up over the years. It seemed like a textbook example of what a long-term dividend investor should want to own.

But fast forward a few years, and the story started to shift. Starbucks has been in full turnaround mode over the past several years, and the financials during that time have been on a downward spiral.

Gross margins have slowly declined, and net profit margins and free cash flow margins have fallen meaningfully since 2021. Free cash flow itself has been declining since then too, and debt has continued to rise since 2019.

Source: Snapstock

To justify the increasing debt, management has pointed to the high returns they get from new store openings, which explains why they’ve felt comfortable borrowing so aggressively. But the combo of declining margins and free cash flow with rising debt is starting to look a bit too sketchy for my liking.

With all of that said, their “Back to Starbucks” plan led by Brian Niccol is the company’s attempt to get things back on track, and if you just listened to the earnings calls, you would walk away pretty optimistic. Still, the more this story plays out, the bigger the gap I’m seeing between the confidence on the calls and what’s actually showing up in the numbers.

Q3 2025 was the company’s sixth straight quarter of declining same-store sales. Plus, EPS was down almost 50% year-over-year, and the company is officially paying out more in dividends than it is generating in free cash flow (and this isn’t the first quarter where that’s happened).

Now, to be fair, a lot of the pressure on free cash flow makes sense when you zoom out. Starbucks is in turnaround mode, so it’s fitting that they’d be spending big to overhaul operations and reposition the brand.

In doing so, they’re rolling out the Green Apron Service model across every U.S. company-operated store in August, which is a full rework of their operating playbook aimed at speeding up service and improving consistency.

They’re also moving away from mobile-order-only stores and focusing on revitalizing existing locations with a more inviting atmosphere and comfortable seating, hoping to bring back that third-place feel.

So in a lot of ways, the declining free cash flow isn’t just a result of poor performance—it’s partly a byproduct of the investments they’re making to try and fix the business. And I actually think a lot of these moves are well aligned with what people have always loved about Starbucks in the first place.

Still, taking everything into consideration, here’s where I ultimately land: I’m afraid that in the midst of all of these investments, paired with the deteriorating financials, the dividend will be sacrificed in the process.

I truly do hope my gut feeling is wrong about that, but when you reach a point where you’re consistently paying out more than you’re bringing in, you can only keep that up for so long. I just didn’t feel comfortable waiting around to see how that plays out, so I thought it would be best to bow out now while I was ahead.

I ended up selling my entire position on July 30th at $93.53 per share. In doing so, I locked in an 8.33% gain in share price and a total return of 14.57% with dividends included. Not a huge win, but I’ll take it.

Source: Charles Schwab

At the time I’m writing this, the stock is now sitting at around $89. It wouldn’t surprise me to see it dip down into the $70s if comps and margins don’t turn around. And honestly, that might create an opportunity to buy back in at a lower price than my original cost basis.

So far, I’ve reinvested some of the proceeds into other companies I can sleep better at night owning. I’ve added to my positions in Zoetis (ZTS) and Procter & Gamble (PG), and I’ve also started buying W.P. Carey (WPC) again for the first time in years.

As far as Starbucks goes, loving the company and loving the stock are two different things. As much as I wish the two were aligned, they just aren’t right now—and I hope that will change in the future.

I’m still rooting for the turnaround though. I hope the investments they’re making pay off in the long run, and I’d love to see margins improve, free cash flow growing, and dividend coverage come back.

At the end of the day, I’ll always be a fan of Starbucks. I just don’t feel good about being a Starbucks shareholder right now.

Now I want to hear from you: What was the last stock you sold, and why did you sell it? Write to me here and let me know.

And if you want to learn about why my friend Russ also sold his stake in Starbucks, check out this video here.

Dividend Investing Democratized

Join thousands of savvy investors in the pursuit of early retirement. Get Retire With Ryne delivered straight to your inbox every week as you build your perpetually growing, cash-flowing dividend stock portfolio.

Blossom is a unique social platform created by investors, for investors. Unlike the usual social media platforms, Blossom is dedicated exclusively to discussions on finance and investing.

I've been actively posting on Blossom since November, and I absolutely love the community over there. With over 200,000 DIY investors, Blossom is buzzing with all sorts of different investment ideas. The coolest part is that you can see everyone's portfolios, which you can automatically link within the app!

Picture Twitter/X, but with an added portfolio tracking feature and less trolling – that's Blossom for you. Personally, I find it much more enjoyable than my experience on Twitter/X, and I think you will too.

Download Blossom today, and follow me (@ryne) to see my complete portfolio and stay updated on all my real-time investment moves.

IN MY PORTFOLIO 📈

Start tracking your portfolio with Snowball Analytics today—free for 14 days! Plus, use code "rynewilliams" at checkout to get 10% off your subscription.

ICYMI 🎥

Time To Sell These Dividend Stocks? | Ep. 30

In this episode of The Deep End, we tackle a tough question: is it time to sell Starbucks (SBUX)? This transitions into a broader discussion about dividend safety, payout ratios, balance sheet strength, and how to think through a potential dividend cut.

CAREFULLY CURATED 🔍

📺 The Truth About Dividends - Dividends tend to get a fair amount of flak. In this video, TJ from the Compounding Dividends channel digs into some of the common criticisms people throw at dividend investing and explores whether there’s actually any truth to them.

🎧 Rebuilding CLEAR - Caryn Seidman-Becker bought Clear Secure (YOU) out of bankruptcy and turned it into the identity platform millions use today. In this episode of the Invest Like the Best podcast, she shares what it took to rebuild the business from scratch—and why she thinks your face is the future.

📚 Buffett's Evolution - John Huber from Base Hit Investing unpacks how Warren Buffett’s success came not from sticking to a rigid investment style, but from knowing when to evolve.

SINCE YOU ASKED 💬

“How do you balance living life now and saving for the future? For context, I currently save 50% of my income and have 3% dedicated to fun money."

- Christian Brown | YouTube

This is such a great question. I think finding that balance between saving for the future and enjoying life now really starts with reverse-engineering your goals.

If you run the numbers—which you can do here—and figure out that contributing a certain amount (for example, $100 or $150 a week) is enough to get you to your financial freedom goals on time, then that’s your baseline.

As long as you’re able to consistently invest that number, anything above that is just bonus. And if some months you don’t go above and beyond, it’s not the end of the world since you've already met your baseline.

With that said, it’s important to make sure your baseline number actually fits within your budget. Having a good handle on your budget tells you what you can realistically afford to invest based on your full financial picture.

Obviously, part of your budget will need to go toward your basic living expenses, but after that, you can do whatever you want with the rest. That's your personal free cash flow.

Interestingly, I've found that the challenge for a lot of investors usually isn’t saving. I think I can speak for most of us when I say that the deeper you get into investing, the more naturally you want to save.

As you start making progress toward financial freedom, discretionary spending just becomes less interesting. While a lot of non-investors see saving as boring, to us, it becomes its own kind of reward. We don't have to save and invest for our future, we get to.

So in that sense, I actually think a lot of investors have the opposite problem. It’s not about finding the discipline to save—it’s about giving yourself permission to enjoy your money once all the essentials are taken care of.

Many of us (myself included) get so focused on scrimping and saving every dollar for our future selves that we forget it’s okay to spend on things that help us enjoy life right now.

In your case, saving 50% of your income is actually incredible. If 3% for fun money feels like enough—and if you’re not bored or feeling like you’re punishing yourself—then keep going with what works.

But if at any point you do feel like loosening your wallet a little bit, it sounds like you have a lot of wiggle room in your budget to do so. It’s not going to throw off your entire financial plan, and it might even help you strike a better balance.

Have a question? Ask me here to see it featured in an upcoming newsletter.

LAST WORD 👋

Obviously, I share my buys and dividend income here in the newsletter every week—but if you’re curious about what’s happening in my portfolio between newsletters, I’ve been posting daily updates over on Instagram.

If you want to stay updated in real time, click here to follow me on Instagram.