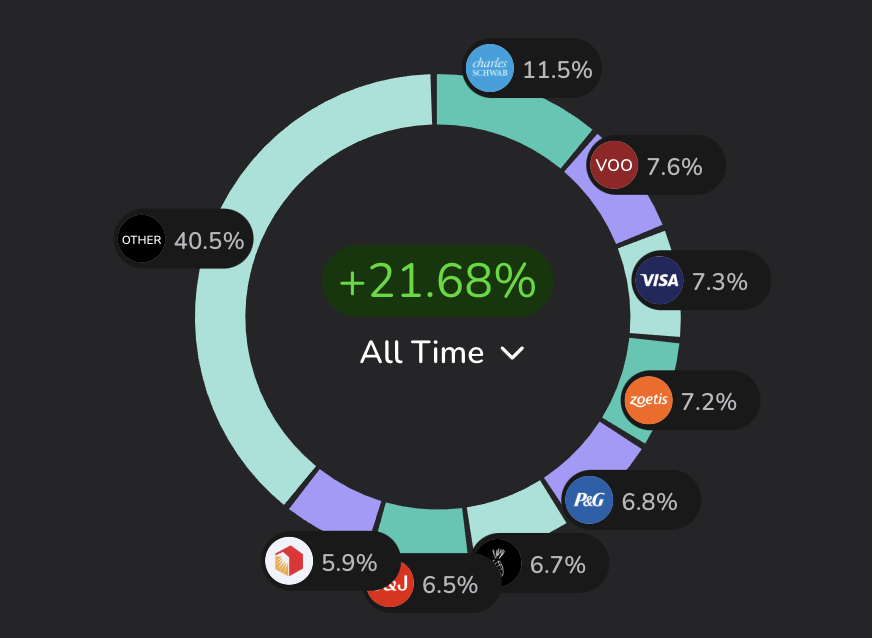

These 5 Stocks Make Up 40% of My Portfolio

PRESENTED BY SNOWBALL ANALYTICS

Disclaimer: This page contains some affiliate links that might just lead you to the promised land of awesomeness (or at least some cool products). I personally use all of the products promoted, and recommend them because they are companies I have found to be helpful and trustworthy. I may receive commissions for purchases made through links in this post.

When it comes to diversification, one of my rules of thumb is to try and avoid letting any individual position make up more than 10% of my portfolio. This doesn’t include ETFs, of course.

For the most part, I’ve done a good job of sticking to that over the years, but I am cutting it close with a few of my holdings right now.

In fact, my top five positions make up about 40% of my portfolio’s total value. In this newsletter, I’m going to walk you through exactly what these holdings are, why I own them, and how much dividend income they’re bringing in for me every year.

#5 — Procter & Gamble (PG)

Procter & Gamble (PG) is one of the most reliable consumer staples companies in the world. I bet you could look around your house right now and find at least a handful of PG products.

Their lineup is full of household essentials—everything from Tide laundry detergent to Pampers diapers to Crest toothpaste—which creates consistent demand no matter what’s happening in the economy. After all, people are always going to brush their teeth and wash their clothes, and babies are always going to need diapers.

PG is also a dividend king that has been growing its dividend for over 65 consecutive years, making it one of the safest sleep-well-at-night (SWAN) stocks you can own. I’m happy to have it as one of my largest positions.

#4 — Zoetis (ZTS)

Zoetis (ZTS) is the world leader in animal health, and the newest addition to my portfolio.

They make health care and pharmaceutical products for the pets we own (cats and dogs) and the animals we eat (poultry, livestock, and fish). Zoetis spun off from Pfizer back in 2013, and is in an industry that’s continues to expand as pet ownership and the demand for protein continues to grow.

The share price has been pretty flat since I started buying it a few months ago, but the business itself has historically been a strong grower. And the dividend has followed suit, with a 5-year dividend growth CAGR of over 20%.

#3 — Visa (V)

I absolutely love Visa (V), which is a company that needs no introduction. I think Visa is the gold standard of stocks, and I can’t think of a more financially perfect company.

Visa is a free cash-flow printing machine, and even though it’s my largest individual stock position (but not by much), I wish I owned twice as many shares. This is one stock I’d definitely break my 10% rule of thumb for.

#2 — Vanguard S&P 500 ETF (VOO)

I don’t talk about VOO as much as my individual stock positions, but this ETF has been a cornerstone of my portfolio and offers something I don’t get from my individual stocks.

With just this one ETF, I get exposure to 500 of the largest U.S. companies—which gives me the opportunity to buy into (and benefit from) the entire American economy.

The yield isn’t huge at around 1.2%, but between share price appreciation and steady dividend growth, VOO makes for a great foundation in the portfolio.

#1 — Schwab U.S. Dividend Equity ETF (SCHD)

SCHD has been the largest position in my portfolio for a while now, and despite the negative sentiment currently surrounding the fund, I still consider it to be the Holy Grail of Dividend ETFs.

With SCHD, you’re not getting sketchy stocks with no proven track record. You’re buying into high-quality, recognizable companies with strong financials and a history of consistently growing their dividends like HD, CVX, and PEP—along with 100 other dividend-paying companies.

With a double-digit dividend growth rate, a solid yield, and a focus on high-quality businesses, it’s been the perfect holding for my dividend portfolio, and it pairs really well with VOO.

Overall, I’m really happy with my top five, and now I’d love to hear from you: What are your top 5 largest positions? Write to me here and let me know.

And if you want to learn about a few stocks that I think are ALMOST PERFECT, check out this video here.

Dividend Investing Democratized

Join thousands of savvy investors in the pursuit of early retirement. Get Retire With Ryne delivered straight to your inbox every week as you build your perpetually growing, cash-flowing dividend stock portfolio.

One of the most essential tools for any investor is a reliable portfolio tracker, and Snowball Analytics is the ultimate command center for your portfolio, providing all the tools you need (and more) in one place.

Plus, it’s one of the only portfolio trackers out there designed specifically for dividend investors.

The layout is clean and intuitive, offering charts, graphs, and other features you didn’t even know you needed but now can’t live without—like the event calendar, portfolio backtest tool, and the dip finder tool (this has been a game changer).

I’ve been using Snowball for a while now, and it's the most in-depth portfolio tracker I’ve ever used (you can see it in action here). I highly recommend it to any dividend investor looking for maximum functionality and data for tracking their portfolio.

Right now, Snowball Analytics is offering a 14-day FREE trial so you can try it out risk-free. The best part is, if you end up loving it (which, as you'll find out, is not hard to do), you can save 10% on your subscription when you use code “rynewilliams” upon signing up.

IN MY PORTFOLIO 📈

Start tracking your portfolio with Snowball Analytics today—free for 14 days! Plus, use code "rynewilliams" at checkout to get 10% off your subscription.

ICYMI 🎥

All Our Dividend Income From August | Ep. 35

In this episode of The Deep End, we break down all of our dividend income from August, share the latest moves we’ve made in our portfolios, and talk through what we’ve got planned for September.

CAREFULLY CURATED 🔍

📺 "Home Base" Investing - When we build our portfolios, what we’re really building is a dependable safe haven for our wealth—a financial home base. PPC Ian believes dividend stocks are one of the best ways to create that foundation, turning your portfolio into both a shelter for stability and a springboard for greatness in life.

🎧 Redefining Value Investing - This episode of the Talking Billions podcast features Monsoon Pabrai, who blends generational wisdom from legendary investors like her father Mohnish Pabrai, Charlie Munger, and Guy Spier with her own unique take on value investing.

📚 Read to Lead - In a world full of noise, reading is a superpower that allows you to learn from the greatest minds throughout history. This article outlines why Buffett and Munger made it the foundation of their success.

SINCE YOU ASKED 💬

"I’m 21, working on a master’s in data science, and I’ve got about $11k invested. I’m stuck in a job I can’t stand (like you once were), and lately I’ve been feeling really demotivated. I don’t know if it’s because I switched to IBKR (which I find super complicated), my mom’s sickness, my job, or just seeing everyone else make progress while I feel stuck. As someone who looks up to you and the goals you’ve achieved, what advice would you give me? I know boosting my income is the key to scaling my portfolio and getting more freedom, but I don’t know how to actually take that next step."

- Tomas | YouTube

I can definitely sympathize with what you’re going through, and I’m really sorry to hear you’re in that spot. Honestly, those exact feelings are what pushed me to start my YouTube channel back in the day.

At first it was a grind, and I had absolutely no idea what I was doing. But just by consistently putting out videos, things slowly started to click, and eventually it all worked out.

That’s why I’m such a big advocate for starting something outside of your job — whether that’s YouTube or something else you can get excited about. You never really know what those things can grow into over time.

With that said, I know these types of projects aren't for everyone. Generally speaking though, if the goal is to increase your income, it usually comes down to one of two paths:

1. Find a new job. Ideally one that pays you more, but even just finding something you don’t hate is already a step in the right direction.

2. Start building something outside of your job. The long-term goal here is that it could eventually replace your job. My version of that was my YouTube channel, but your version can look completely different. These days, it's more possible than ever to create a career around something you’re interested in.

It's important to know that neither of these options are easy. Both take time, patience, and a lot of trial and error.

But in the long run, I think either of them is a lot better than staying stuck in a situation you hate. That’s its own kind of hard, and it doesn’t really move you forward. It's only going to make you more miserable as time goes on.

The fact that you’re only 21, already investing, pursuing a master’s degree, and thinking about this stuff tells me you’re way ahead of where I was at your age. It might not feel like it in the day-to-day, but you're on the right path.

Keep up the good work and know that things will work out in the long run.

Have a question? Ask me here to see it featured in an upcoming newsletter.

LAST WORD 👋

Obviously, I share my buys and dividend income here in the newsletter every week—but if you’re curious about what’s happening in my portfolio between newsletters, I’ve been posting daily updates over on Instagram.

If you want to stay updated in real time, click here to follow me on Instagram.