My Top Dividend Stock For March

In the last month, there were quite a handful of stocks that saw more red than a Minor Threat concert.

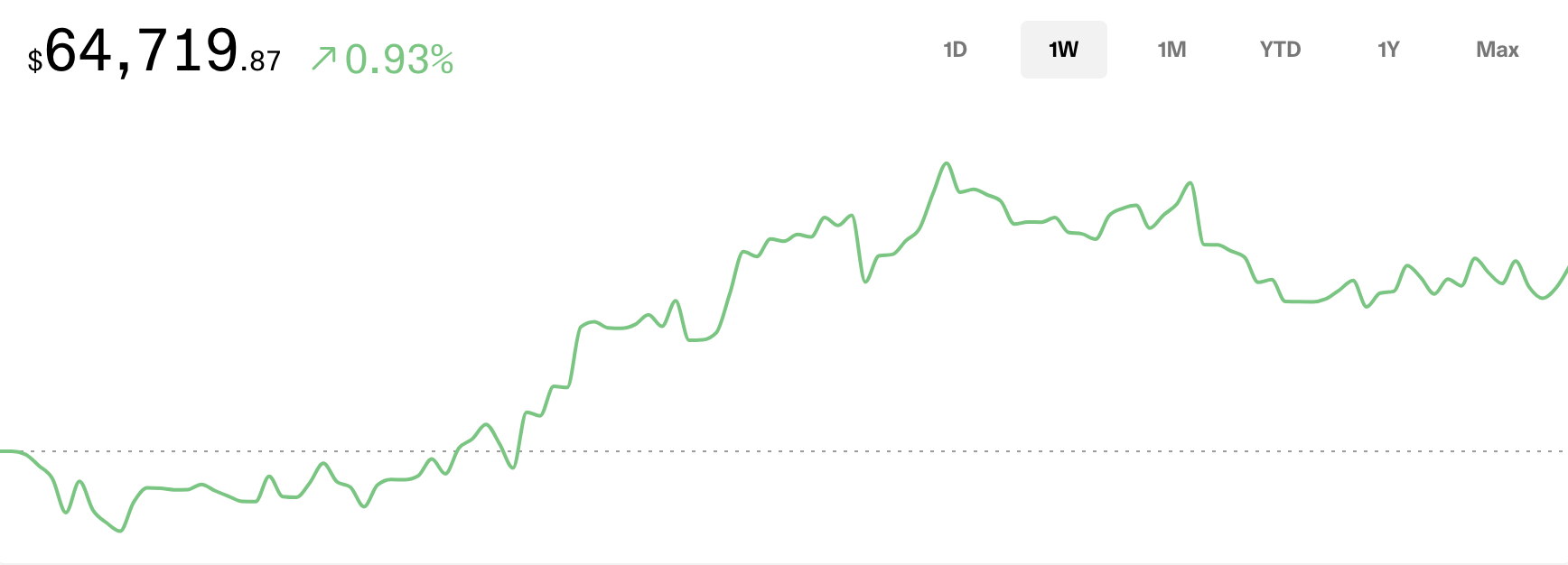

Source: Seeking Alpha

As a result, there seems to be quite a few good looking deals on the market right now, three of which I’m telling you about here. Out of all of those, one company that I’m really liking, and just recently bought A LOT of, is Realty Income (O).

Realty Income’s share price has fallen about 5% in the last month and nearly 20% over the past year, mainly as a result of higher interest rates, which has undoubtedly created a more difficult operating environment for real estate investment trusts.

Obviously, when it comes to anything related to real estate, debt is a pretty important component. REITs will borrow money to buy more properties and grow their business, but when interest rates go up, borrowing money becomes more expensive. This will eat into the company’s profits because they have to pay more in interest.

Recently, there's been talk of the Federal Reserve lowering interest rates, and it seems like investors were banking on that to start happening pretty soon, which would certainly benefit companies like Realty Income. However, it’s beginning to look like these rate cuts will be delayed a bit longer, which is why we saw a lot of REITs get hit pretty hard in the last month.

This is the double-edged sword of dividend investing. On one hand, it doesn’t feel great to see your stocks becoming less valuable. But on the other hand, when the share price goes down, it creates a good opportunity to buy these stable, cash-flowing businesses like Realty Income at a lower share price.

You’re able to get more bang for your buck, and speaking personally, that’s an opportunity I was happy to take advantage of.

I recently picked up about 30 shares of Realty Income at just under $52/share, which officially makes it the largest position in my portfolio.

Source: getquin | My top five largest positions

With that said, I bet I’m far from the only one taking advantage of Realty Income’s currently discounted prices. It wouldn’t be a stretch to say that this is one of the most popular dividend stocks out there, and I think that’s for good reason.

Realty Income has a huge, diverse portfolio of over 15,000 properties across the U.S. and Europe, and as a net lease REIT, their tenants are responsible for things like property taxes and maintenance, which means higher margins (and less headaches) for the company.

Also, Realty Income locks their tenants into long-term lease agreements, typically 10 years or more, providing a steady stream of rental income even during tough times. History shows that their occupancy rates have remained high, never dipping below 96%, even during challenging periods like the Covid pandemic and the 2008 financial crisis.

While higher interest rates do pose a risk to companies like Realty Income in the short-term, overall, I think it will continue to be a solid long-term choice for investors, so it is my top dividend stock pick for March.

Anyway, enough about me, I want to hear from you: Which stocks do you have your eye on for this upcoming month? Write to me here and let me know.

And a big thank you to all of the readers who responded to last week's newsletter! You can read some of the responses down below in the "Hot Takes" section. 👇

Dividend Investing Democratized

Join thousands of savvy investors in the pursuit of early retirement. Get Retire With Ryne delivered straight to your inbox every week as you build your perpetually growing, cash-flowing dividend stock portfolio.

I use Seeking Alpha every single day, and have done so for years now. It's my go-to website for everything related to stock research, and it's been essential in helping me become a better investor.

Whether I'm looking up dividend stats, reading the news, listening to earnings calls, or just want to find out what others are saying about a particular stock, Seeking Alpha has it all for free, and the Premium version is even better.

The Premium version gives you unlimited access to Seeking Alpha's library of articles, personalized portfolio tracking tools, and a ton of other essential features for the dedicated dividend investor. You can see the full list of Premium features here.

Right now, Seeking Alpha is offering a 7-Day FREE Trial of their Premium platform so you can try it out risk-free. The best part is, if you end up loving it (which if you're like me, you definitely will), you'll automatically get $50 OFF of your annual subscription.

It's normally $239 for the year, but with the discount it comes out to $189, so you're saving about 20%. I've been using it for years, and have definitely found it to be worth the money.

If nothing else, it's at least worth checking out the 7-Day FREE Trial.

IN MY PORTFOLIO 📈

Track your portfolio for free with getquin. You can also follow mine there (@ryne) to see all of my purchases, dividends, and other updates in real-time.

ICYMI 👀

How To Find Your Circle of Competence

When you invest in what you know, you have an advantage. This is what Warren Buffett calls your Circle of Competence, and this is how you find it.

CAREFULLY CURATED 🔍

📺 Life Before/After Dividend Investing - As explained in this video, choosing how to invest your money is not just about the numbers. As a human, your emotions play a big role too, even though they're harder to measure. And while many people focus only on the math, it's important to understand that there's more to consider when selecting an investing strategy. You have to adopt an approach that fits your temperament, even if others criticize it and prefer a different way of doing things.

🎧 The Dividends Show - Growth companies get a lot of the glory in investing. But don't sleep on dividend stocks, as something seemingly more snooze-worthy can be the source of a whole lot of wealth creation.

📚 A Fund With A 94% Yield? - If you're thinking this is about TSLY, you're right. When you see a distribution yield as high as this one, you better believe there's a catch.

SINCE YOU ASKED 💬

"Do you ever see yourself selling out of all or at least most individual stocks and putting everything into SCHD?"

- @ogigrobar | YouTube

This is a fantastic question! While I have been making more of an effort to consolidate some of my individual stock positions, having sold 4 of them in the last few months (which you can learn more about here), I don't see myself ever wanting to go all in on ETFs.

While I am a big fan of ETFs, and put money into ones like SCHD and VOO every week, investing in individual companies is kind of a hobby for me. Over time, I've really come to enjoy researching and selecting the companies I believe to be good long-term investments. Plus, investing in individual companies helps me practice what I've learned about investing.

With that said, I don't ever see myself selling all my individual stocks, but I do plan to keep consolidating my portfolio over time. Over the last few months, I've narrowed my individual positions down from 23 to 19, and may keep lowering it even more.

I'm not going to rush it though. I'm pretty content with where things are at right now.

Have a question? Ask me here to see it featured in an upcoming newsletter.

HOT TAKES 🔥

Last week, I asked readers which stocks came to mind when they thought of "safe" dividend stocks. Here are some of the responses:

John said: KO, XOM, CVX...too many to list.

Fil said: When I think of safe dividend paying companies, 3 come to mind: Visa/Mastercard, Costco, and of course Microsoft. If we look just on pure dividend growth and payout ratio, those 3 companies offer amazing, sleep-well-at-night dividend growth. You know they can increase it by double-digit percentages on a yearly basis. And with Costco, you can expect every 3-4 years to get a nice little gift with a special dividend.

Alyssa said: I think WMT is one of the safest stocks out there. I DCA into this one every month, and even though it doesn't have the highest yield, I think it will be a steady payer for years to come.

Chris said: PG is easily one of the safest stocks out there in my opinion. People will always need things like tooth paste and deodorant.

Disclaimer: This page contains some affiliate links that might just lead you to the promised land of awesomeness (or at least some cool products). We may receive commissions for purchases made through links in this post. It's nothing fancy, but it certainly does the job!