2 Dividend Stocks I’m Selling (and 2 That I Might)

A few months ago, I shared a video talking about my decision to sell out of some dividend stocks from my portfolio. Since then, I've given the boot to two of them: JEPI and INTC.

While I managed to squeeze out a small total return on both, there are still two more stocks on my chopping block: T and VZ — both of which I’m taking a loss on.

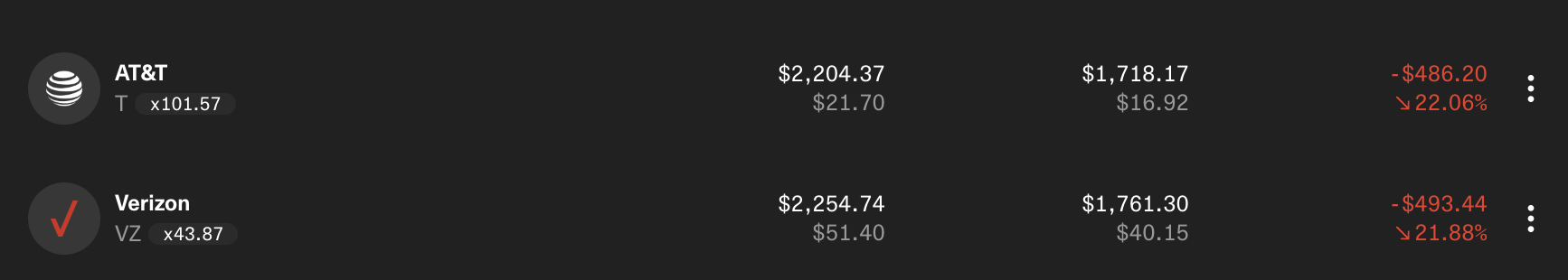

Source: getquin | My T and VZ positions

But thank goodness for dividends! Looking at the total returns, I’m only down about 4% with T and 10% with VZ.

As it so happens, these two were among the first dividend stocks I ever invested in. I was admittedly drawn to their high dividend yields as a brand new investor, and didn’t understand as much about either company as I do now.

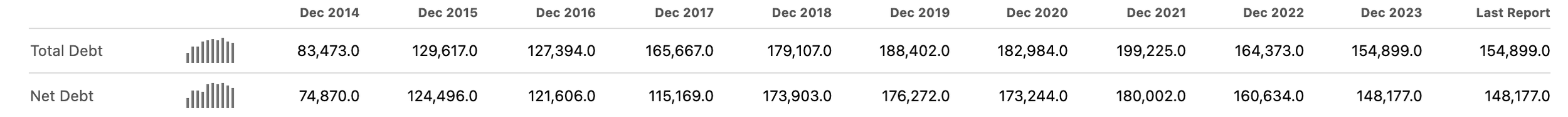

At a point too late, I learned that these companies carry hefty amounts of debt due to the capital-intensive nature of their operations. They constantly need to invest in maintaining and upgrading their infrastructure, and often finance these expenses by borrowing money.

Consequently, both of these companies are carrying hundreds of billions of dollars of debt on their balance sheets, which creates a potentially unwanted risk for the investor.

Source: Seeking Alpha | T’s Total Debt and Net Debt

Having said all of that, I’ve rethought their position in the portfolio. While I think T and VZ are likely to keep churning out dividends, I’m confident that there are better opportunities for me to invest in.

Truth be told, I've held onto both of these longer than I should. I’m stubbornly waiting for something that may never come: a rebound.

But as my main man Russ likes to say, "You don't have to make it back the same way you lost it.”

Overall, selling T and VZ for a loss will sting a bit, but neither company is a massive position in the portfolio, each making up only about 3%. It’s a loss I can handle, and I’m confident that I’d see a better return if reinvested elsewhere.

Now, onto some other potential consolidation moves.

I recently watched a video from another one of my investing compadres, Lanny, who talked about having over 70 individual stocks in his portfolio.

In the video, he talks in-depth about how he came to have so many different holdings, and how being too over-diversified (more specifically, how having too many small positions) can negatively impact your focus and potentially dilute your returns.

Hearing him talk about all of that hit me like a ton of bricks, and had me thinking about my own portfolio.

Over the years, I've accumulated quite a few smaller positions. Take SO, for example. It's done well for me (up 25%, including dividends), but it's not exactly a needle-mover in my portfolio with a mere 2.2% weighting.

And then there's KO (also up 25%, including dividends), a legendary dividend king, but still, a small player in my portfolio with a 2.5% weighting.

These positions, while they've served me okay, are taking up space (both mental and financial) that could be allocated to more promising opportunities. Although I think they’re fine companies, I’m questioning whether or not they’re worth keeping in the long run.

Selling off T, VZ, SO, and KO would help to streamline my portfolio, reducing the number of positions from 21 to 17. It would also boost my cash reserves (by a lot), giving me more ammunition to reinvest into better dividend-paying opportunities.

With that said, letting go of stocks is such a difficult thing to do, but is sometimes a necessary step in leveling up your portfolio.

I think of it as taking one step back to take two steps forward. It’s all about optimizing your portfolio for the long haul, and hopefully, if carried through, these moves would do exactly that.

Only time will tell.

Disclaimer: This page contains some affiliate links that might just lead you to the promised land of awesomeness (or at least some cool products). We may receive commissions for purchases made through links in this post. It's nothing fancy, but it certainly does the job!