SCHD: The Holy Grail of Dividend ETFs Is Back

Disclaimer: This page contains some affiliate links that might just lead you to the promised land of awesomeness (or at least some cool products). I may receive commissions for purchases made through links in this post.

Watch the video version of this here.

For the past few years, being an SCHD shareholder hasn’t exactly been fun (dividends aside, of course).

While AI took over every headline and easy growth felt abundant, dividend investing very much fell out of favor. During this time, we dividend investors have been on the receiving end of our fair share of ridicule.

According to those riding the growth wave, if you cared at all about generating cash flow instead of chasing the latest tech trend, you were basically a dinosaur. Your strategy no longer “worked.”

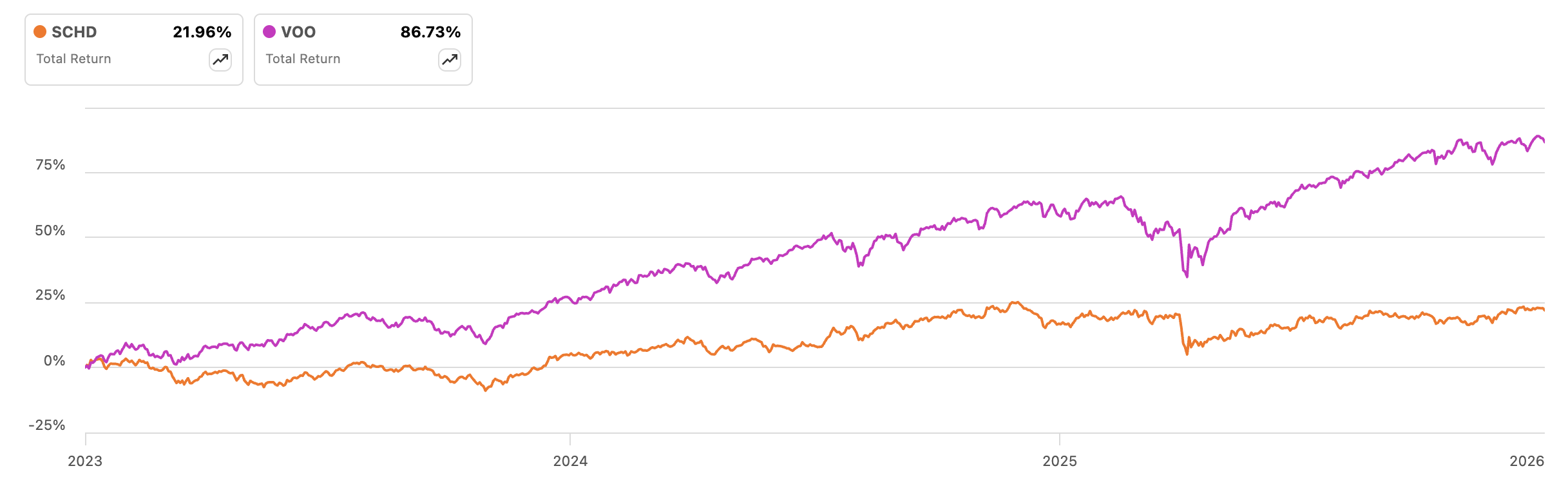

And during that stretch, SCHD didn’t do much. From 2023–2025, SCHD stayed relatively flat — generating about a 22% total return compared to nearly 90% for the S&P 500.

Source: Seeking Alpha

But then something interesting happened.

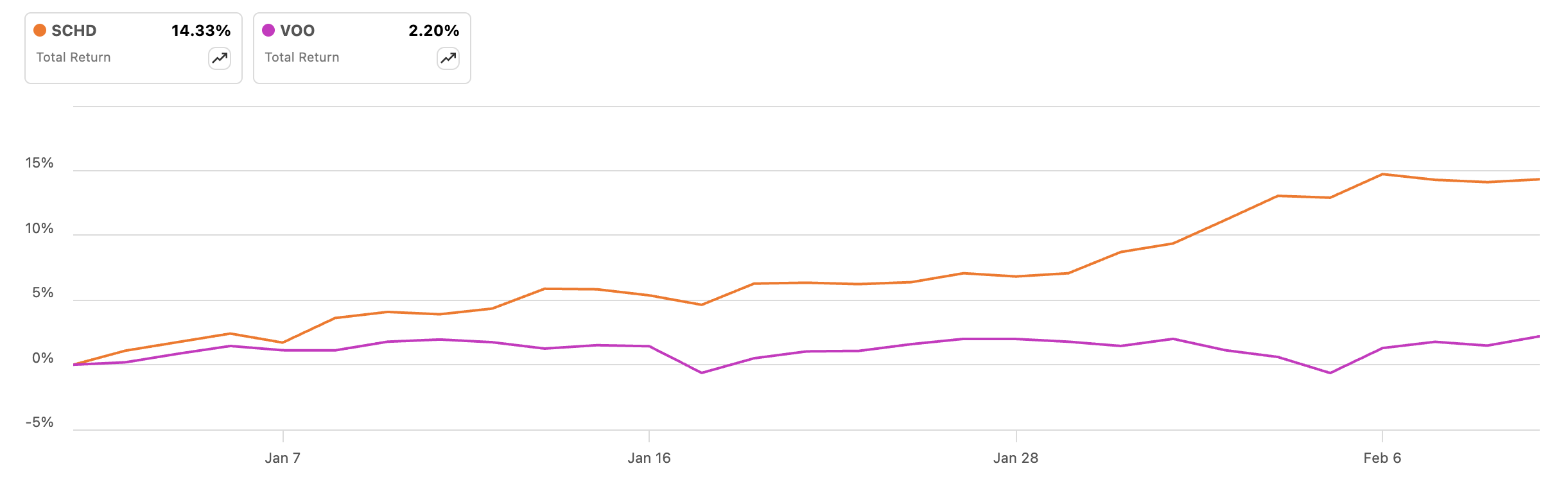

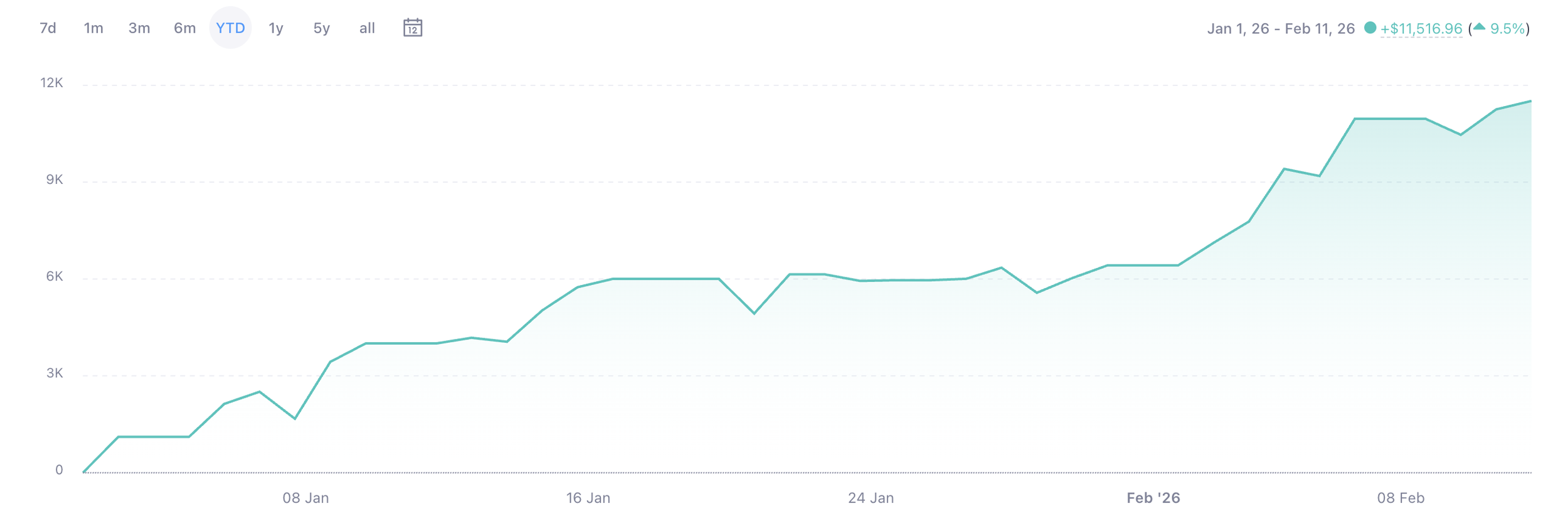

Here in 2026, SCHD is up close to 15% year to date and has suddenly outperformed many of the same growth funds that dominated the market over the past few years. The switch flipped almost immediately as we entered the new year.

Source: Seeking Alpha

All of a sudden, SCHD is “back.” Now everyone loves it again. And now — somehow — everyone saw it coming.

As happy as I am to see the fund performing well (since it is my largest holding), it’s easy to look at SCHD’s current run with the benefit of hindsight and say, “I knew this would happen.”

But the truth is, nobody saw this breakout coming. Nobody ever knows what the market is going to do next.

SCHD outperforming at this exact moment was impossible to predict. What was inevitable, though, was that the market would change at some point — because it always does.

Markets move in cycles with ebbs and flows. And when you’re living through a period where your strategy isn’t the one that’s hot, it can feel permanent. But it never really is.

Yesterday’s winners can quickly become tomorrow’s laggards. And yesterday’s losers can quickly become tomorrow’s leaders. That’s just how markets work.

This is why Charlie Munger said that the big money isn’t earned in the buying and selling, but in the waiting. (For the record, Tom Petty said something along these lines too — that’s probably where Munger got it from.)

Dry spells and down periods will test you in a way that bull markets never could. You’ll find yourself questioning your decisions, tempted to change strategies, and at times believing that you had it all wrong.

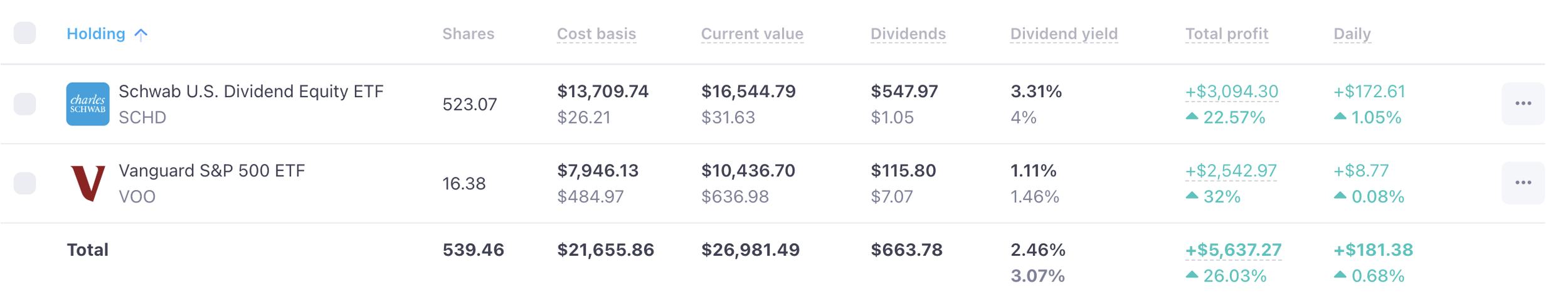

The thing is, though, you can never really have it wrong when you have balance. And looking at this rotation we’re seeing in the market, that’s one of my biggest takeaways.

I’m reminded how important it is to have a well-balanced portfolio — or an all-weather portfolio, as I like to call it.

Source: Snowball Analytics

If you’re dollar-cost averaging into a diversified, well-balanced portfolio, you don’t need to know what’s going to outperform next. In fact, you don’t even have to think about what’s happening inside your portfolio. All you have to do is keep buying.

While SCHD was flat for the past few years, anyone who continued adding shares during that dry spell was able to build a larger position at lower prices — and they’re benefiting from that today.

And as this cycle continues to evolve, the same thing applies in reverse. If growth continues to cool off, that allows you to accumulate those assets at better prices too.

All in all, trying to predict what the market is going to do next is futile. The smartest thing you can do as an investor is position yourself to benefit from whatever it does — and that only comes from having balance.

Having said all of that, I’m curious to know: How many shares of SCHD do you have in your portfolio? Write to me here and let me know.

Dividend Investing Democratized

Join thousands of savvy investors in the pursuit of early retirement. Get Retire With Ryne delivered straight to your inbox every week as you build your perpetually growing, cash-flowing dividend stock portfolio.

I use Seeking Alpha every single day, and have done so for years now. It's my go-to website for everything related to stock research, and it's been essential in helping me become a better investor.

Whether I'm looking up dividend stats, reading the news, listening to earnings calls, or just want to find out what others are saying about a particular stock, Seeking Alpha has it all (for free), and the Premium version is even better.

The Premium version gives you unlimited access to Seeking Alpha's library of articles, personalized portfolio tracking tools, and a ton of other essential features for the dedicated dividend investor. You can see the full list of Premium features here.

Right now, Seeking Alpha is running a Valentine’s Day sale, and it’s one of the better deals I’ve seen from them.

They’re offering a 7-day free trial of Seeking Alpha Premium, plus 15% off if you decide to stick with it. That takes the price from $299 down to $254 for the year — a $45 discount — and you still get the free trial to try it out first.

The sale is running through February 15th, and it’s only available for new subscribers. At the very least, it’s absolutely worth checking out the 7-day free trial while the Valentine’s Day discount is live.

IN MY PORTFOLIO 📈

See my full portfolio with all of my holdings, trades, and dividends on Snowball Analytics! Plus, use code "rynewilliams" at checkout to get 10% off your subscription.

ICYMI 🎥

This Is The Hardest Skill In Investing

In this episode of The Deep End, we dive into why doing nothing is often the hardest (and most valuable) skill in investing, why chasing fast money almost always slows you down, and why timeless principles still matter as products, platforms, and incentives continue to evolve.

SINCE YOU ASKED 💬

"Snap-on’s dividend yield is only around 2.4%, while inflation is closer to 3%. Why invest in a stock like this instead of focusing on companies with higher yields?"

- Hackintosh | YouTube

This is a fantastic question, and it’s one I get pretty often. It also points to one of the biggest misconceptions about dividend investing as it relates to inflation.

The mistake most people make is comparing a stock’s dividend yield directly to the inflation rate and thinking that the dividend income is “losing” to inflation if the yield is lower. That thought process makes sense on the surface, but it’s actually the wrong comparison.

Inflation measures how fast your purchasing power is eroding over time. To figure out whether a stock's dividend is keeping up, you don’t compare inflation to the yield — you compare it to the dividend growth rate.

You see, the dividend yield tells you how much income you’re getting today relative to the stock's share price. Dividend growth, on the other hand, tells you how fast that income is growing over time. Since inflation is a rate of change, it needs to be compared to another rate of change.

Referring back to Snap-on (SNA) from the question, its dividend has been growing by about 14.6% per year, which definitely outpaces inflation. That means your dividend income — and your purchasing power — is increasing on a net basis over time.

Now compare that with a higher-yielding stock that barely grows its dividend, like STAG Industrial (STAG). STAG has only grown its dividend by around 0.7%, which doesn’t keep up with inflation — meaning your real purchasing power is shrinking.

That’s just one of the main reasons why you should focus on dividend growth and the business fundamentals rather than a stock's dividend yield alone.

Have a question? Ask me here to see it featured in an upcoming newsletter.

LAST WORD 👋

I love hearing from you all, and I'm always looking for feedback. How am I doing with the newsletter? Is there anything you'd like to see more or less of? Which aspects of the newsletter do you enjoy the most?

Your insights on these matters are essential in making this newsletter the best it can be. If you want to help, take a moment to share your thoughts by completing this quick form. It'll take you less than 60 seconds - guaranteed.

Thanks in advance!