Why Dividends Still Matter

Disclaimer: This page contains some affiliate links that might just lead you to the promised land of awesomeness (or at least some cool products). I may receive commissions for purchases made through links in this post.

By now, you probably know that most of what I write about revolves around well-established, dividend-paying businesses.

But a friend of mine (shoutout to Jose) recently asked if I would ever consider investing in something different. Specifically, he wanted to know if I’d ever thought about investing in earlier-stage companies whose products I actually use.

Normally, I’d save a question like that for the Since You Asked section of this newsletter. But every so often, I’ll get asked something that deserves a bit more room to breathe.

As I started thinking through my response, it quickly turned into a much bigger conversation about incentives, what investing actually is, and why dividends matter to me in the first place — all of which I want to unpack here.

First off, there actually are a handful of younger, growth-oriented companies that I use in my day-to-day life and have always kept in the back of my mind as potentially interesting investments.

The first one that comes to mind is Adobe (ADBE). I’ve used Adobe’s suite of software for close to a decade now, and every single video I’ve edited on my YouTube channel has been made using Premiere.

Because I've used their software for so long, it's like second nature to me. Switching to a new platform would mean relearning an entirely new workflow, and who wants to do that?

For that to be worth it, the alternative would have to be dramatically better. And that’s a hard hurdle to clear when most editing software does roughly the same thing.

All of that is to say that I have no intention of switching anytime soon, and my first-hand experience with Adobe's products tells me something important about its customer behavior and competitive advantage.

Another company I’ve always kept in the back of my mind is Spotify (SPOT). Like Adobe, I’ve been a loyal user for nearly a decade and would find it very difficult to switch to a competing platform like Apple Music.

At this point, all of my playlists, listening history, and personalization live inside Spotify. The platform knows what I like because it’s learned from years of behavior.

Just like with Adobe, switching would mean starting from scratch. And if the alternative platform does more or less the same thing, I don’t see what the real incentive would be.

All of this naturally raises the question: would I ever actually invest in either of these companies? My default answer is “never say never.” But for now, I’m not interested — mainly because neither company pays a dividend.

To some, that might sound like a lame reason to pass on an otherwise solid business inside my circle of competence. After all, if you shouldn’t invest in a company just because it pays a dividend, you also shouldn’t automatically rule one out simply because it doesn’t. That’s a fair argument.

Still, the presence of a dividend is something that matters a lot to me. I don’t have rigid rules around how high a yield needs to be or how fast a dividend must be growing, but I don’t love the idea of being entirely dependent on share price appreciation. I also don’t love the idea of effectively writing management a blank check.

Even if the yield is low, the commitment to pay a dividend creates a tangible obligation to return cash to shareholders. I think that accountability matters — even if it's slight — and I think it can show up in decision-making over time.

Broadly speaking, I don’t think it’s unreasonable to want a share of a cash-flowing business’s profits. Receiving that cash flow makes investing feel much closer to actual business ownership, and that’s how I think about myself as an investor.

Not as someone simply allocating money to these things that randomly move up and down on a screen, but as a partial owner of living, breathing businesses.

Having said all of that, now I want to hear from you: Do you invest in any companies that you use in your daily life? Write to me here and let me know.

Dividend Investing Democratized

Join thousands of savvy investors in the pursuit of early retirement. Get Retire With Ryne delivered straight to your inbox every week as you build your perpetually growing, cash-flowing dividend stock portfolio.

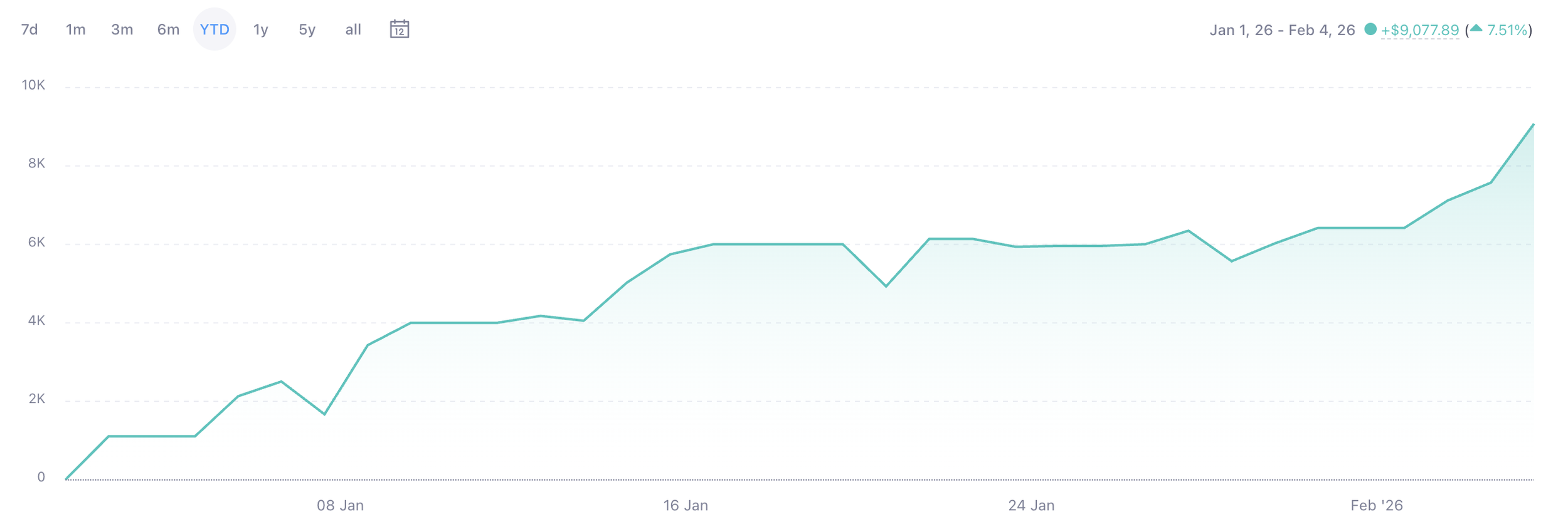

IN MY PORTFOLIO 📈

Start tracking your portfolio with Snowball Analytics today—free for 14 days! Plus, use code "rynewilliams" at checkout to get 10% off your subscription.

ICYMI 🎥

The Same Mindset That Builds Wealth Builds Everything Else

In this episode of The Deep End, we explore why small daily decisions matter more than big, emotional ones, how discipline compounds faster than money, and why committing before motivation shows up is often the real edge.

CAREFULLY CURATED 🔍

📺 Modern Value - In his talk at CFA Society UK, Vitaly Katsenelson does a great job explaining why modern value investing looks very different than the textbook version.

🎧 Joyful Excellence - On this episode of the Richer, Wiser, Happier podcast, William Green sits down with bestselling author Brad Stulberg to unpack how the world's top performers combine consistency and rest to drive long-term results while avoiding burnout.

📚 Ownership Lost? - Daniel Peris (one of my favorite writers) takes a step back and asks what investing really means if dividends disappear — not just from corporate policy but by design.

LAST WORD 👋

If you haven’t already, you should check out my FREE Discord group. Think of it as one big group chat with nearly 4,000 dividend investors who are just as obsessed with this stuff as you are.

It’s a positive, no-drama community where people share their buys, sells, and dividend income, and talk stocks 24/7. Whether you’re just starting out or you’ve been at it for years, you’ll find people ready to answer questions, celebrate wins, and help you grow as an investor.

It’s totally free to join — and I think you’ll get a ton of value out of being part of the community.