3 Reasons Why I Can’t Stop Buying VICI Properties

Disclaimer: This page contains some affiliate links that might just lead you to the promised land of awesomeness (or at least some cool products). I may receive commissions for purchases made through links in this post.

If you’d rather watch the video version of this newsletter article, click here.

Over the past six months, VICI Properties’ (VICI) share price has dropped by more than 15%, which is a dip I’ve been taking advantage of big time.

Since the beginning of November alone, I’ve added 42 shares to my position, and there are three distinct reasons why I’ve been loading up on this company lately despite its poor performance, and that’s exactly what I want to tell you about in this newsletter.

Reason #1: Despite the Rumors, Vegas Isn’t “Dead”

A big reason VICI’s share price has suffered lately is tied to the broader narrative around Las Vegas itself, where VICI has a major presence.

You’ve probably heard some version of it by now. Headlines and YouTube video titles have all been saying that “Vegas is dead.”

Behind the headlines are claims that fewer people are visiting, and tourism to Vegas is bleeding out. The narrative is that the party’s over, and that the city has lost its luster.

To be fair, tourism numbers have come down from recent highs this past year. But I think the public’s (and the market’s) reaction to that has been pretty knee-jerk and overexaggerated.

We’ll get into some of the numbers in just a moment, but first, it helps to understand why visitation has mellowed out.

One reason is that there has been noticeably less international travel, especially from Canada. A lot of Canadian travelers are boycotting U.S. travel, primarily driven by geopolitical tensions, and have simply chosen not to come to the States. That’s had a real impact on Vegas, which historically benefits from strong international traffic.

On top of that, Vegas has undeniably gotten more expensive. Food and drinks cost more than they used to, table minimums at the casinos are higher, and resort fees have gotten out of control.

When you put all of that together, Vegas doesn’t feel like the cheap getaway destination it once was, and visitors have been feeling squeezed. And I think that shift has caused some people to stay home or travel elsewhere.

Despite all of that, when you actually look at the numbers, you’ll come to find that Vegas is still very much alive (and thriving).

According to the most recently available numbers, year-to-date through the end of November 2025, Las Vegas had about 35.5 million visitors. That works out to roughly 3.23 million visitors per month.

And importantly, that number is only 7.4% lower than the same year-to-date period in 2024 — a year that was close to being a record for total visitation.

So when headlines talk about Vegas being “dead,” it’s easy to imagine something dramatic — empty casinos, vacant hotels, and tumbleweed rolling down Las Vegas Blvd.

But in reality, what we have here is a city that’s still attracting over three million visitors every single month, even after coming off one of the strongest tourism runs in its history.

Plus, it’s important to remember that travel is cyclical. There are always ebbs and flows, and this is definitely not the first time Vegas has seen a year-over-year dip in visitors.

Overall, this is not a long-term problem.

Reason #2: VICI Is Smack Dab In The Center Of My Circle of Competence, and I’m Very Bullish on Vegas Long Term

One reason I feel so strongly about VICI Properties — and why I think it’s a fitting investment for me — is because I live in Las Vegas.

Although that does admittedly make me biased, it also gives me a boots-on-the-ground perspective that I think is advantageous here.

Even though VICI owns plenty of properties outside of Las Vegas, their Strip assets are really what they’re known for, and I get to see them first-hand every day.

Despite the recent tourism slump, my lived experience of Vegas is that this is a city that’s constantly changing and evolving — both on and off the Strip. There are always reasons to visit, and importantly, those reasons continue to expand.

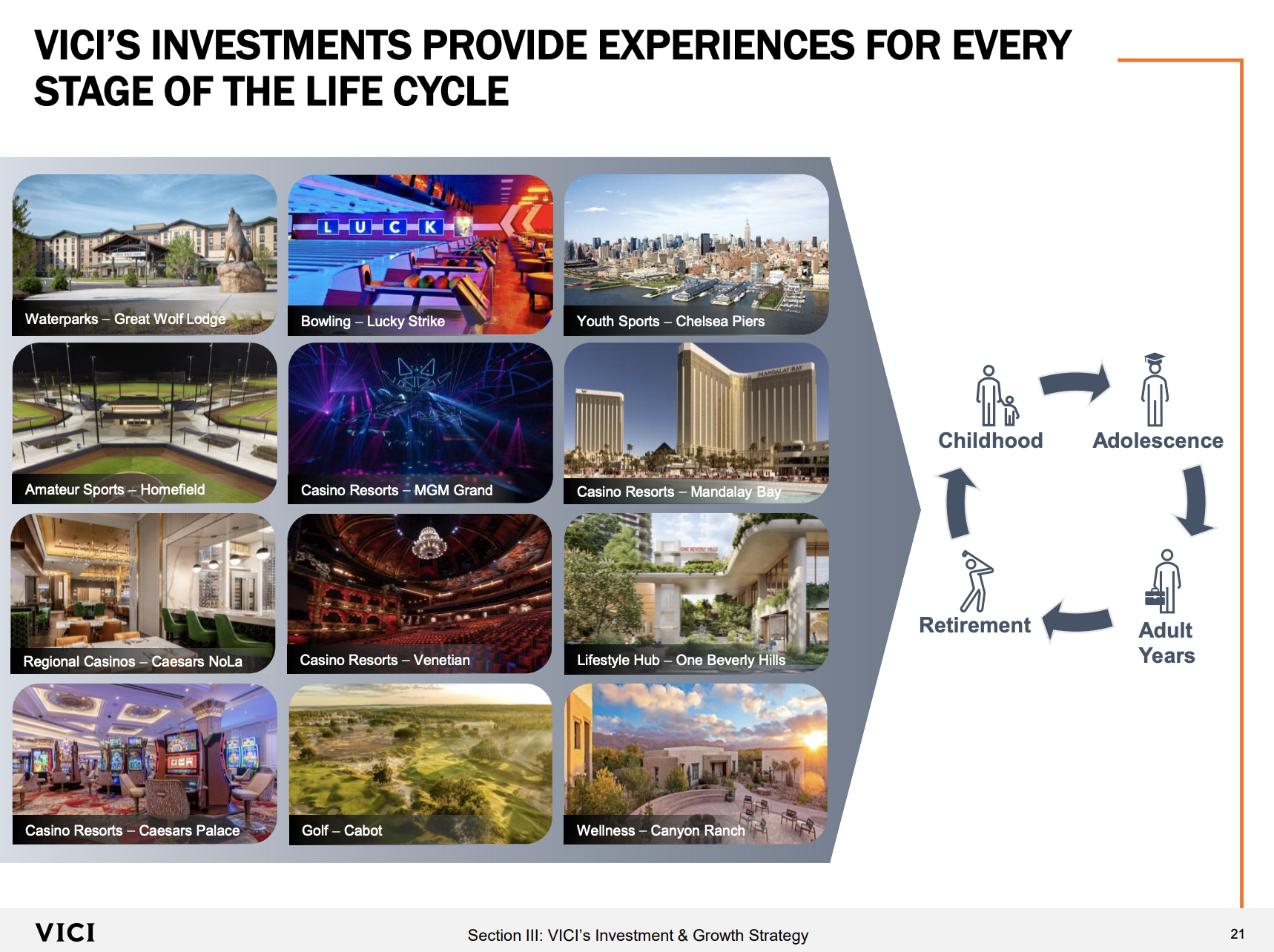

Source: Investor Presentation

Yes, Vegas has always been about partying and gambling — and it definitely still is today.

But it’s also become a destination for world-class dining, entertainment, and business travel. The convention and conference scene here is an underrated advantage that doesn’t get talked about nearly enough — that alone drew 5.7M visitors this year.

And then there’s sports. Vegas has an NFL team, an NHL team, a WNBA team, and soon, we’ll have an MLB team. Not to mention, there’s also the annual F1 Las Vegas Grand Prix, which draws over 300,000 visitors just for the weekend.

All of that is to say that Vegas is no one-trick pony. In my opinion, there’s no other place like it on earth, and it just keeps getting better over time.

Reason #3: Despite the Tourism Concerns, VICI Is Still Fundamentally Strong and Growing

One thing that consistently gets left out of the conversation around VICI and its recent slump is how the company actually makes its money.

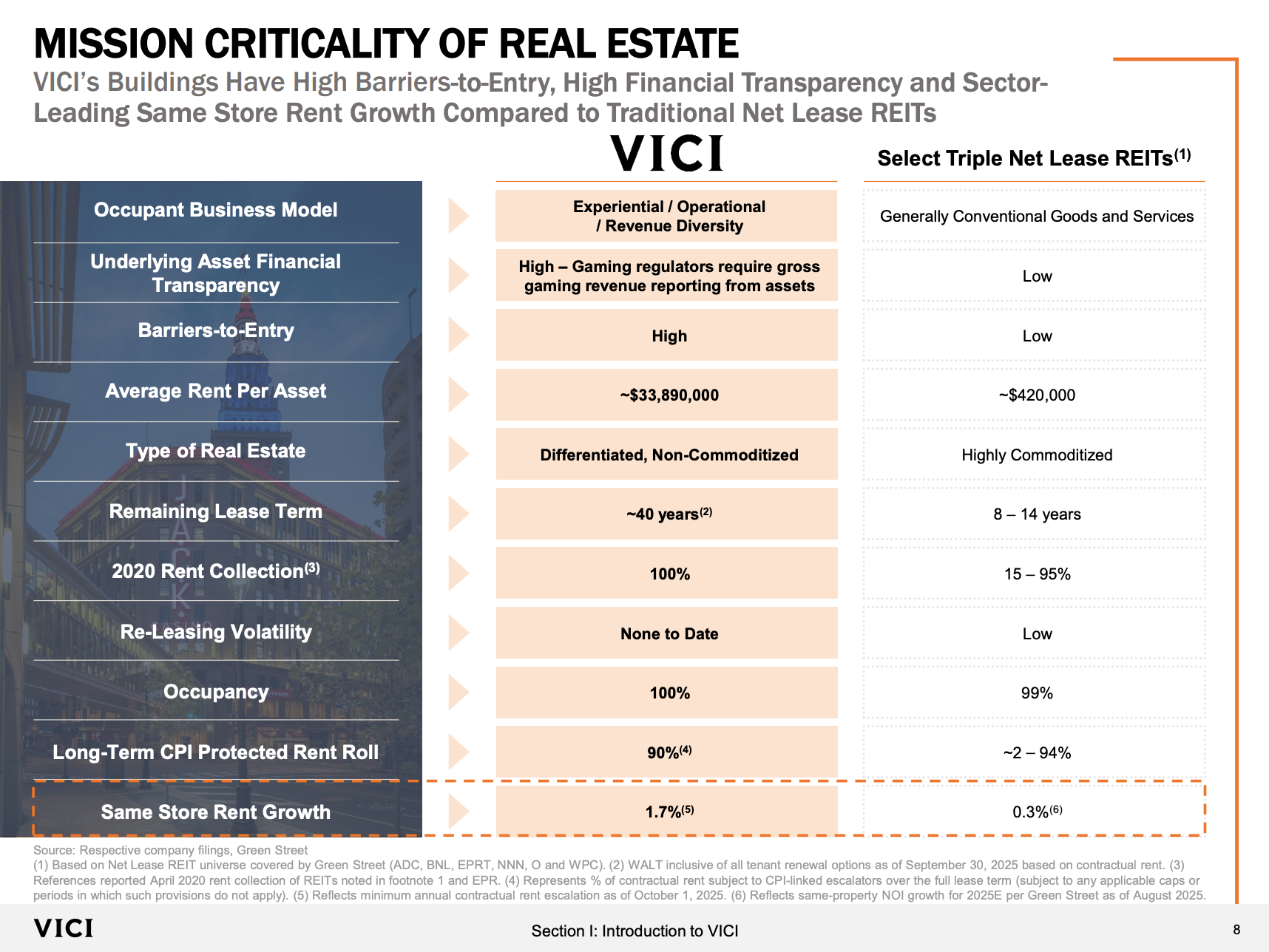

A lot of investors worry about declining tourism numbers as if that directly impacts VICI’s revenue. But VICI isn’t a casino operator. They’re the landlord.

Their revenue isn’t tied to how many people walk through the doors — it’s tied to long-term lease agreements with their tenants. Those payments are fixed, contractual, and highly predictable.

In other words, even if fewer people come to Las Vegas, VICI is still entitled to its rent. We actually saw this play out in real time (and in a big way) just a few years ago.

In the years leading up to 2020, Las Vegas regularly saw around 42–43 million visitors per year. In 2020, that number collapsed to just 19 million — a decline of more than 50%.

I actually visited during the summer of 2020, and it was pretty surreal. The Strip felt like a ghost town.

And yet, VICI still maintained 100% occupancy and still collected 100% of its rent from tenants. The business didn’t skip a beat.

Now, that doesn’t mean the same thing will happen in the future or that things could never change. But it does showcase how resilient VICI’s business model is, even during extremely poor times for tourism.

On top of that, VICI’s portfolio of properties isn’t confined to just Las Vegas. They’ve invested in a wide range of experiential assets all across North America, including bowling alleys, golf courses, indoor waterparks, and youth sports facilities.

Source: Investor Presentation

And nearly all of these properties are leased under triple-net agreements with extremely long durations — averaging around 40 years. That dramatically improves revenue predictability, reduces turnover risk, and has helped VICI consistently grow both its cash flow and dividends over time.

Source: Investor Presentation

And thanks to the recent pullback in share price, the dividend yield has been pushed up to around 6.5%, which is way higher than the company’s historical average yield of 5.2%.

Conclusion

All in all, no business is completely immune to setbacks. But from what I can see, the ones VICI is facing are both temporary and manageable, which is why I’ve been relishing the opportunity to buy more shares.

With all of that said, now I want to hear from you: Do you think VICI is a buying opportunity right now, or is the tourism slump keeping you away? Write to me here and let me know.

Dividend Investing Democratized

Join thousands of savvy investors in the pursuit of early retirement. Get Retire With Ryne delivered straight to your inbox every week as you build your perpetually growing, cash-flowing dividend stock portfolio.

IN MY PORTFOLIO 📈

Start tracking your portfolio with Snowball Analytics today—free for 14 days! Plus, use code "rynewilliams" at checkout to get 10% off your subscription.

ICYMI 🎥

How Much Yield Is TOO MUCH Yield?

In this episode of The Deep End, we sit down with Spencer Dunbar to talk about the rise of high-yield and weekly dividend ETFs, the growing obsession with income investing, and why so many investors are chasing yield without fully understanding the risks.

CAREFULLY CURATED 🔍

📺 $600 to $118K - Jake from Dividend Growth Investing tracks a decade of dividend income growth and breaks down the decisions that made that compounding possible.

🎧 Cut Through the Noise - In this episode of The Dividend Mailbox, Greg explains why patience and discipline are the most important qualities you can have in a world where endless headlines pull you in every direction.

📚 To Be Sure - In a world of constant change, Morgan Housel’s inaugural blog post for 2026 is a collection of ideas about what tends to stay true over time.

SINCE YOU ASKED 💬

"I have a Traditional IRA. I’ve read that this can make sense if your retirement income will be lower than your current W-2 income, since the tax impact would be less. How do you think about Traditional vs. Roth IRAs, and which one is best?"

- Matt | Email

To answer your question, there isn’t a single “best” IRA across the board. Like you said, it really comes down to your tax situation now versus what you expect it to look like later.

A Traditional IRA can make a lot of sense if you’re in a high tax bracket today and expect to be in a lower one in retirement, since you get the tax deduction up front.

On the other hand, a Roth IRA tends to be great if you think your tax rate in retirement will be similar (or higher) than it is today, or if you just like the idea of having tax-free withdrawals later on (which, who doesn’t).

To be honest, both of them have their benefits, and I think there’s an argument for having both instead of just one or the other.

Have a question? Ask me here to see it featured in an upcoming newsletter.

LAST WORD 👋

I love hearing from you all, and I'm always looking for feedback. How am I doing with the newsletter? Is there anything you'd like to see more or less of? Which aspects of the newsletter do you enjoy the most?

Your insights on these matters are essential in making this newsletter the best it can be. If you want to help, take a moment to share your thoughts by completing this quick form. It'll take you less than 60 seconds - guaranteed.

Thanks in advance!