Turbocharge Your Dividend Income With These High-Yield Stocks

Disclaimer: This page contains some affiliate links that might just lead you to the promised land of awesomeness (or at least some cool products). I personally use all of the products promoted, and recommend them because they are companies I have found to be helpful and trustworthy. I may receive commissions for purchases made through links in this post.

I’m only 31 years old, and because I’m still (unfortunately) a ways away from living off my dividend income, I usually come at this investing stuff with a long runway in mind. That’s why I tend to gravitate toward companies—like Visa (V), Zoetis (ZTS), and Williams-Sonoma (WSM)—where the real payoff only comes with time.

With these dividend payers, the yield might seem underwhelming at first glance, but they tend to aggressively raise their dividend payouts year after year—turning a slow stream of income today into a raging river of cash flow a decade from now.

Having said that, while these companies certainly play an important role on this uphill climb to financial freedom, my ultimate goal is to build what I call an “all-weather portfolio”—something well-balanced that can withstand whatever the market throws at it.

To do that, I think you need a little bit of everything. Not just dividend growth stocks, but also those on the opposite end of the dividend spectrum: high-yield dividend stocks that are shelling out serious cash-flow right now.

But here’s the catch: with great yield comes great risk. If you’re not careful, the double-digit yielder that you think will fast-track you to financial freedom might end up just being a big fat yield trap. I’m telling you more about those and how to avoid them here.

With that in mind, I’m not just sharing the stocks with the highest yields—I’m sharing the ones that I believe strike a solid balance between yield, reliability, and growth potential (because we still want to see increasing payouts over time).

OBDC – Yield: 11.88%

Blue Owl Capital Corporation (OBDC) is the second-largest publicly traded business development company (BDC) in the market today.

If you’re not familiar with what a BDC is, it’s basically a company that lends money to (or invests in) privately held businesses—often mid-sized or smaller companies that can’t (or don’t want to) go the traditional bank route.

In exchange, OBDC gets to collect interest payments—and right now, those payments are pretty juicy.

Source: Investor Relations

Roughly 77% of their portfolio is in first lien loans. That’s important because in the world of lending, being in first position means you’re first in line to get paid if things go south. For our purposes, this is a signal of how conservative they are with their lending practices.

On top of that, about 97% of their debt investments are floating rate, which means the interest income they collect goes up when interest rates go up. That’s a big reason why they’ve done so well in this higher rate environment.

Source: Seeking Alpha

All that extra income has also allowed them to issue special dividends every quarter over the past few years on top of the regular dividend, which already yields close to 12%. And the cherry on top is that they’ve grown that dividend nearly 10% every year over the last 3 years.

That’s pretty impressive for a stock with such a high yield, and in my opinion, that makes OBDC double-trouble in the dividend department.

HTGC – Yield: 10.87%

Next up is Hercules Capital (HTGC)—another BDC, but with a slightly different twist.

Unlike OBDC, which is externally managed, HTGC is internally managed. What that means is that the people running the business are actual employees of the company—not hired out from a third-party management firm.

That can lead to better alignment with shareholders, and therefore, more consistent long-term decision-making. Not to mention, there are fewer costs involved since you don’t have to pay any management fees.

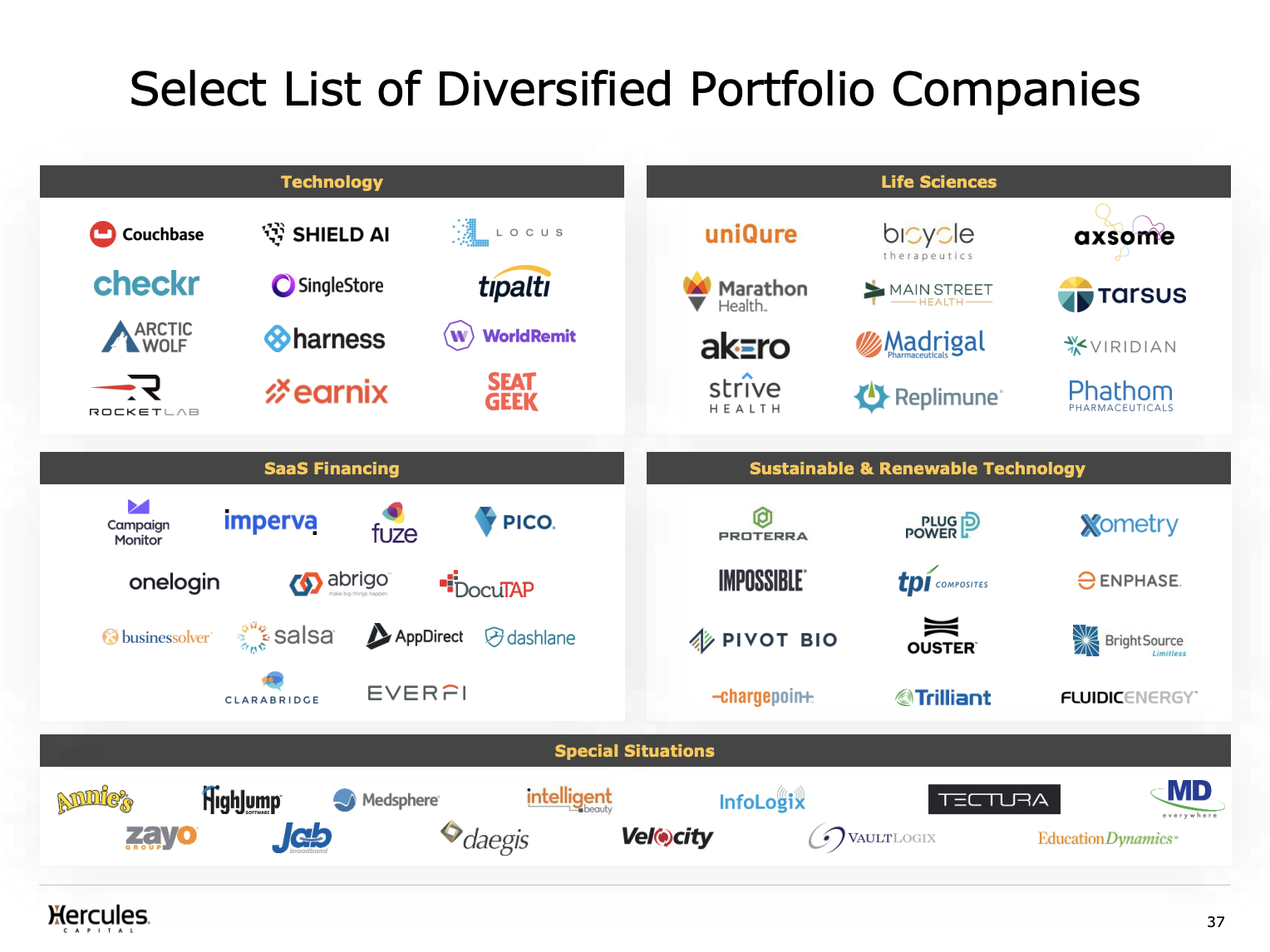

Source: Investor Relations

HTGC specializes in venture lending—providing capital to high-growth companies in tech, life sciences, and SaaS.

That naturally gives it more exposure to risk, but with that also comes the potential for higher returns. Historically, they’ve walked this line in perfect stride, and have grown their net investment income by about 16% every year for the past decade.

Source: Seeking Alpha

On the dividend side of things, the yield is currently sitting just under 11%, and they’ve consistently increased their payouts for the past 8 years. That’s a solid track record for any company, but especially one that sits in the high-yield end of the spectrum.

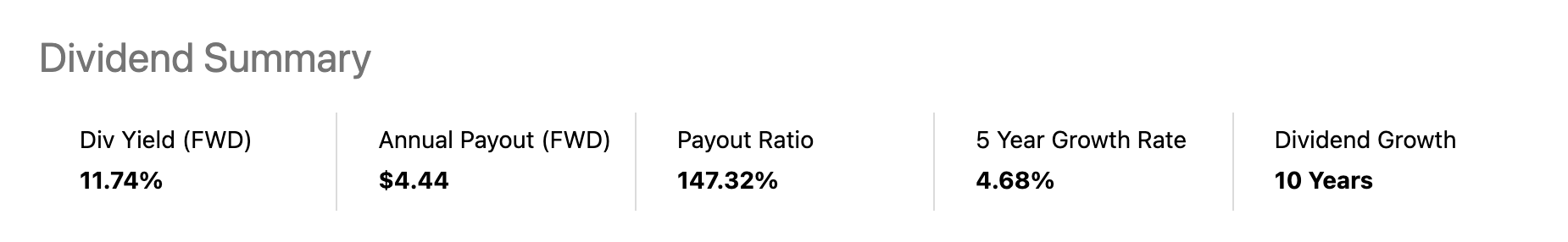

DKL – Yield: 11.74%

Last but not least, we have Delek Logistics Partners (DKL). Unlike the last two companies, this one isn’t a BDC—it’s a midstream energy company, structured as a Master Limited Partnership (MLP).

Source: Investor Relations

Basically, midstream companies like DKL handle the boring (but essential) work of transporting oil and refined products around the country.

They do this through their network of pipelines, storage tanks, and—more recently—they’ve also taken on water logistics in places like the Permian Basin.

Source: Seeking Alpha

DKL currently yields just under 12%, and has the longest dividend growth streak of the three companies we’ve looked at today.

With that, you’ll notice that their payout ratio is 147%, which normally would be cause for concern. But with MLPs, the payout ratio based on net income can be misleading.

The better metric to look at is the distribution coverage ratio, which compares how much distributable cash flow the company generates relative to the distributions it’s paying out.

Source: Investor Relations

In DKL’s case, that number is typically between 1.2x and 1.4x. That means their payouts are very well covered, and leads me to believe the dividend is totally safe, even with such a high yield.

Quick note: MLPs come with some tax implications you’ll definitely want to learn about before buying any shares. I highly recommend you study up here.

Out of these three companies, I personally only own OBDC, but I think all three of these are solid bets if you’re looking to turbocharge your cash flow.

And with that said, now I want to hear from you: What are the highest-yielding dividend stocks in your portfolio? Write to me here and let me know.

And if you want to learn about some more high-yielding stocks that you should definitely NOT buy, check out this video here. These ones are trouble, and you should avoid them at all costs.

Dividend Investing Democratized

Join thousands of savvy investors in the pursuit of early retirement. Get Retire With Ryne delivered straight to your inbox every week as you build your perpetually growing, cash-flowing dividend stock portfolio.

I use Seeking Alpha every single day, and have done so for years now. It's my go-to website for everything related to stock research, and it's been essential in helping me become a better investor.

Whether I'm looking up dividend stats, reading the news, listening to earnings calls, or just want to find out what others are saying about a particular stock, Seeking Alpha has it all (for free), and the Premium version is even better.

The Premium version gives you unlimited access to Seeking Alpha's library of articles, personalized portfolio tracking tools, and a ton of other essential features for the dedicated dividend investor. You can see the full list of Premium features here.

Right now, Seeking Alpha is offering a 7-Day FREE Trial of their Premium platform so you can try it out risk-free. The best part is, if you end up loving it (which if you're like me, you definitely will), you'll automatically get $30 OFF of your annual subscription.

It's normally $299 for the year, but with the discount it comes out to $269. I've been using it for years, and have definitely found it to be worth the money.

If nothing else, it's at least worth checking out the 7-Day FREE Trial.

IN MY PORTFOLIO 📈

Portfolio performance provided by Snowball Analytics

ICYMI 🎥

Why Many Investors STRUGGLE To Build Long-Term Wealth | Ep. 18

In this episode of The Deep End, Ari and I discuss why many investors have such a hard time building long-term wealth.

CAREFULLY CURATED 🔍

📺 Dividends vs. Real Estate - Cash-flow seeking investors tend to gravitate toward two things: dividend stocks and rental real estate. But which one’s actually better? JP Dividends breaks down the pros and cons of each in this video.

🎧 Tools of the Trades - Snap-on (SNA) isn’t just one of my favorite dividend growth stocks—it’s also one of the best-performing positions in my portfolio. This episode of the Business Breakdowns podcast does a great job laying out why Snap-on has been, and likely will continue to be, a solid long-term investment.

🎧 Warren Buffett's Last Ride - Another must-listen: this year's Berkshire Hathaway Annual Shareholder Meeting, where Warren Buffett and Greg Abel spent over four hours answering questions from the audience.

SINCE YOU ASKED 💬

"Where do I start with researching stocks? And how do I know if I have done enough research on a company? Do you think that going through the investor presentation, the latest annual report, the company's website, and a few metrics/stats for the company would be enough?"

- Sotiris | Email

When it comes to researching stocks—especially as a brand-new dividend investor—the three most important questions you want to answer are: Do I understand this company? Is the company growing? And is the dividend safe?

What you listed out is honestly a great place to start in trying to answer those questions. And just by doing those few things, you’re already putting in more work than many other investors.

I really like investor presentations because they give you a lot of high-level information about the company, how it operates, and some of the numbers behind it. And it’s usually presented in a pretty easy-to-understand way, which makes it perfect if you’re just getting started.

From there, annual reports and quarterly earnings calls are a great next step. They give you a deeper look inside the business and help you understand its strengths, risks, competitors, and more.

These might feel a bit less beginner-friendly at first, but they’re definitely worth the effort—and just reading one annual report can often tell you whether or not a company is going to be in your wheelhouse.

Now when it comes to gauging growth and dividend safety, there are a lot of helpful resources.

You’ll get some of the raw data from the company’s filings, but I prefer to use tools like Snapstock or Seeking Alpha that show you a decade’s worth of financial trends in one place. That type of presentation really helps when you're trying to understand how a business is growing over time.

With that said, the more reps you get looking at different businesses, the more your process will naturally grow and evolve. You’ll figure out what matters to you, what doesn’t, and you'll come to develop your own method to the madness. Like anything else, it just takes practice.

As for knowing when you’ve done enough research—that’s harder to define. I think that’s where investing becomes part art, part science.

In my experience, you’ll never feel 100% certain about an investment—because things can always go differently than you plan—but if you’ve done the work to understand how the business makes money, and if you feel good about its long-term trajectory, that may be a good sign that you’re ready to pull the trigger.

And if after all that you still feel unsure, then the answer is probably “no”—at least for now.

Have a question? Ask me here to see it featured in an upcoming newsletter.

LAST WORD 👋

I love hearing from you all, and I'm always looking for feedback. How am I doing with the newsletter? Is there anything you'd like to see more or less of? Which aspects of the newsletter do you enjoy the most?

Your insights on these matters are essential in making this newsletter the best it can be. If you want to help, take a moment to share your thoughts by completing this quick form. It'll take you less than 60 seconds - guaranteed.

Thanks in advance!