Shutterstock (SSTK)

Last Updated: 8/25/2024

The content provided on this website, including any communications, posts, videos, social media interactions, and other materials, is for informational and educational purposes only. It should not be considered as financial or investment advice. Read our full disclaimer here.

Background

Company Overview

In their own words, Shutterstock “helps creative professionals and casual creatives from all backgrounds and businesses of all sizes produce their best work with incredible content, innovative tools and powerful data, all on one platform.”

In a nutshell, Shutterstock is a marketplace for and distributor of stock images, videos, sounds + music, and 3D models. The company brings together users and contributors of content (creators + customers), and serves as a database for readily-searchable content that their customers can pay to license by way of subscription or a-la-carte packages.

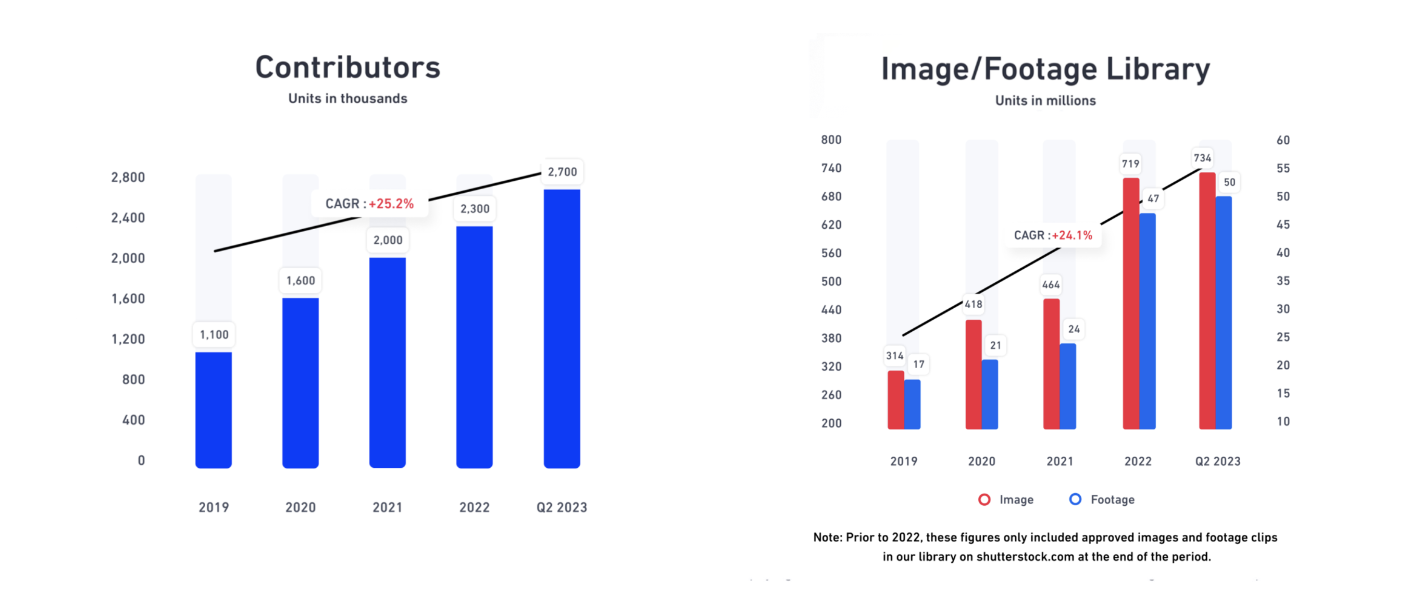

The company has one of the largest libraries of stock content available on the internet with over 700+ million images and 50+ million videos, and a current network of over 2.7 million contributors.

Through acquisition, Shutterstock also owns:

Giphy: a company that operates a collection of GIFs and stickers that supplies casual conversational content. The company believes this acquisition extends their audience touchpoints beyond primarily professional marketing and advertising use cases and expands into casual conversations.

According to their website, Giphy is used, “everywhere your conversations are happening. From iMessage, to Facebook, Instagram, Snapchat, TikTok… and everywhere in-between.”

Pond5: A video-first content marketplace offering royalty-free and editorial video. Shutterstock believes this acquisition can provide operational synergies with expanded offerings across its currently library of content.

Splash News: A UK based entertainment news network offering additional synergies with their library of content that focuses on celebrity, red carpet, and live events.

PicMonkey: An online graphic design and image editing platform, similar to something like Canva. The company believes this acquisition provides their customers with professional grade, easy-to-use design tools.

TurboSquid: A 3D model focused marketplace with over 1 million models. Their customers are game developers, news agencies, architects, visual effects studios, advertisers, and other creatives. The company believes this acquisition establishes Shutterstock as the premium destination for 3D models as well as 3D models in an easy-to-use 2D format.

How Does The Company Make Money?

The majority of revenue is earned from the licensing of content, which is usually purchased through subscription on a monthly or annual basis. Otherwise, customers can purchase individual content licenses at the time of download (a-la-carte).

Shutterstock’s business model is as such:

Content Engine: The main component of Shutterstock’s business operates like a flywheel. Their marketplace matches content creators with customers and powers their Content Engine featuring images, videos, music, sound effects, 3D models, editorial, and generative AI content which can be used for:

Social media + digital advertising

Web design

Blogging

Graphic design

App + other UI

Publications

Video content creation - i.e. YouTube content creators and professional production studios

Audio/music production

GIFs, memes, and stickers

Creative Engine: This area of their business provides Enterprise customers with the workflow tools and studio services to help them meet their custom content production needs.

Data Engine: Whether it’s licensing the metadata associated with the content, incorporating technology such as generative AI into their offerings, or offering predictive insights based on performance data, the company sees an opportunity to further leverage their Data Engine.

Shutterstock’s customer sales are diversified across the following channels:

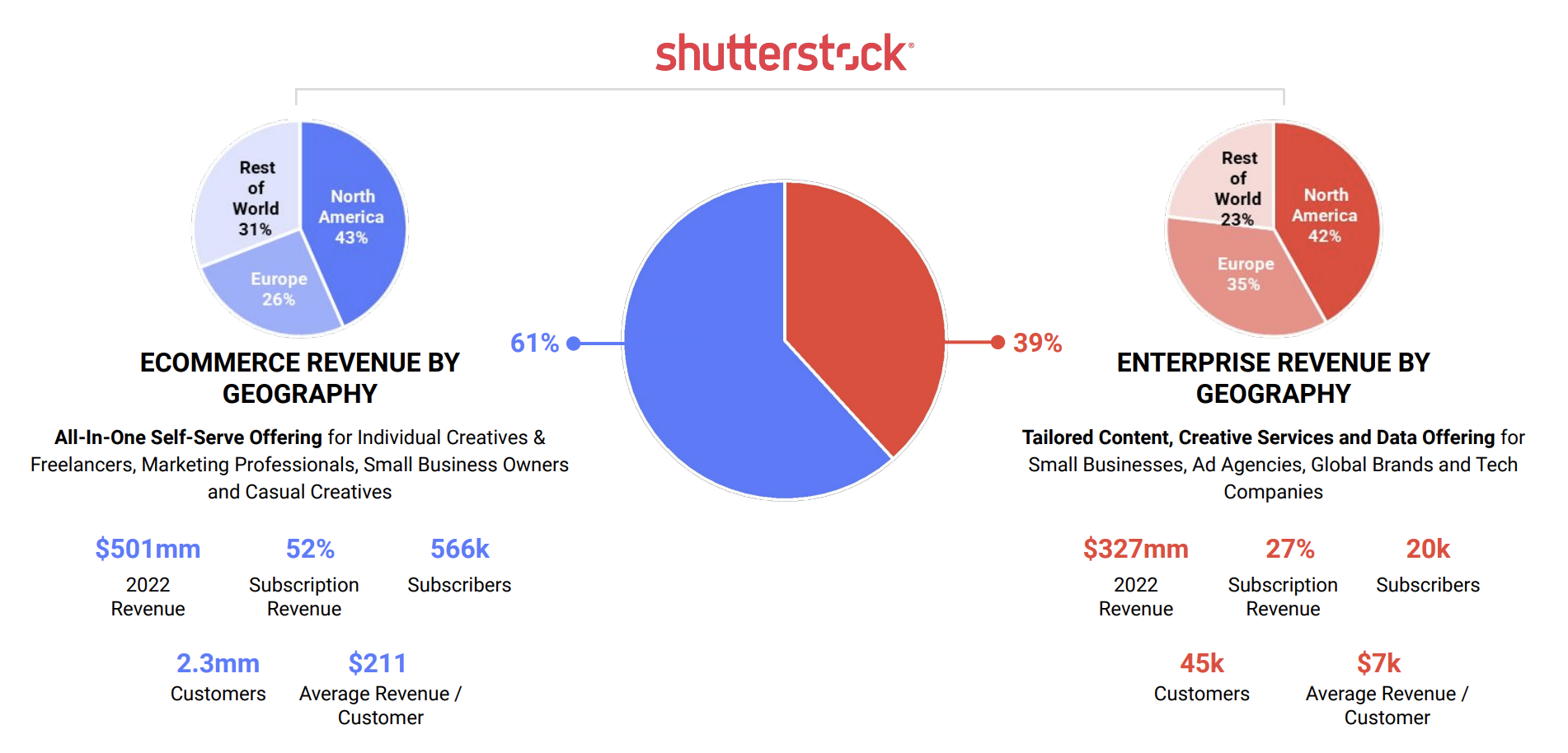

E-commerce: The majority of customers license content directly through Shutterstock’s web platform. Customers in the e-commerce sales channel license content on a monthly or annually recurring subscription basis.

Enterprise: Enterprise customers have unique content, licensing and workflow needs that exceed those of the subscription-based E-commerce customer. These customers typically require custom-tailored enhancements to their creative workflows including non-standard licensing rights, multi-seat access, ability to pay on credit terms, multi-brand licensing packages, and increased indemnification protection. Enterprise customers also work with Shutterstock to create custom content not already found in the pre-existing library.

Some of Shutterstock’s Enterprise customers include:

Overall, Shutterstock is able to serve customers across multiple channels, with a considerable percentage of their total revenue being subscription based [pg. 7 of their Investor Day presentation].

Industry Overview

Shutterstock operates in a competitive, yet rapidly growing industry.

The industry is rapidly evolving with low barriers to entry. Some of their competitors include:

Other online platforms that feature marketplaces for stock content such as Getty Images and its iStockphoto offering, AdobeStock, Freepik, Storyblocks, Pexels, and Motion Array

Specialized visual content companies that are established in local, content or product-specific market segments, such as Visual China Group

Providers of commercially licensable music such as Universal Music Publishing Group, Sony/ATV Music Publishing and Warner/Chappell Music. Included in this are other platforms like Epidemic Sound

Websites focused on providing creative workflow tools such as Canva, Picsart, and Bending Spoons — not to mention popular workflow softwares like Photoshop and Lightroom

Websites focused on image search and discovery such as Google Images

Providers of free images, photography, music, footage and related tools

Social networking and social media services

Commissioned photographers and photography agencies

Generative AI companies - Shutterstock’s strategic partnership with Open AI

In addition, the alternative of creating one’s own content or choosing not to consume licensed content is a type of competition for the company

Financials

Shutterstock has demonstrated impressive top and bottom line growth across all time periods.

Over the last 10 years, their revenue CAGR has been nearly 12%, while their EPS CAGR has been significantly higher at over 50%.

However, Free Cash Flow Per Share has been somewhat inconsistent. From 2014 to 2021, Shutterstock experienced strong Free Cash Flow growth, but since then, Free Cash Flow Per Share has consistently declined.

As a result, the Free Cash Flow Payout Ratio is currently above 100%. While this isn’t overly concerning if it’s a one-time occurrence, it could become problematic for the dividend if it turns into a trend, so this is something to keep an eye on with Shutterstock.

Shutterstock has consistently maintained high gross margins, though its net and free cash flow margins have experienced more variability, particularly in recent years.

Historically, the company has been quite profitable, but recent data indicates challenges that have impacted these margins, especially net profit. The decline during the TTM period stands out as quite a departure from previous years and is worth keeping an eye on.

If this downward trend continues, it could indicate rising competition, increasing costs, higher R&D spending (which has been going up over the years), or other strategic investments that are impacting the bottom line.

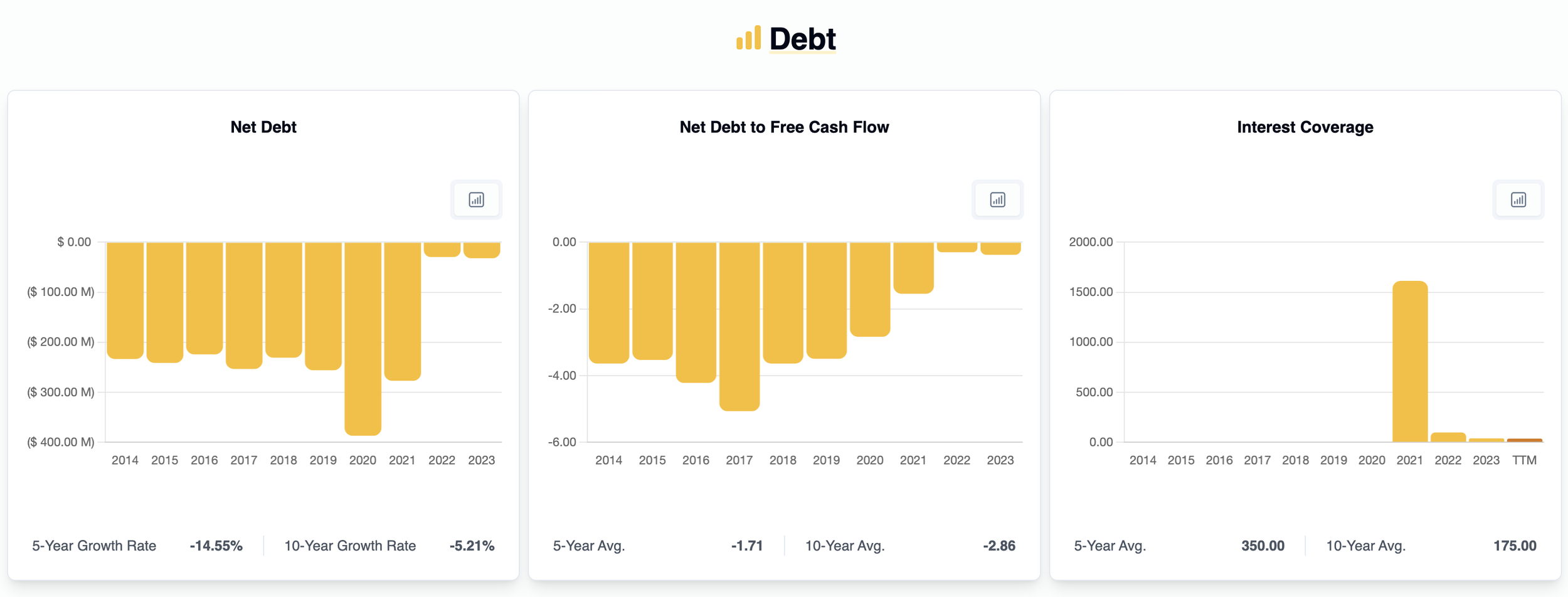

Shutterstock's balance sheet shows negative net debt, meaning they have more cash and liquid investments than total debt. In other words, they could pay off their entire debt with their liquid assets and still have funds left over.

As a result, I don’t think Shutterstock is at any risk of going bankrupt anytime soon. This is one of my favorite things to see in a company, adding to its Sleep Well At Night (SWAN) appeal, and giving investors one less thing to worry about.

Management

Capital Allocation

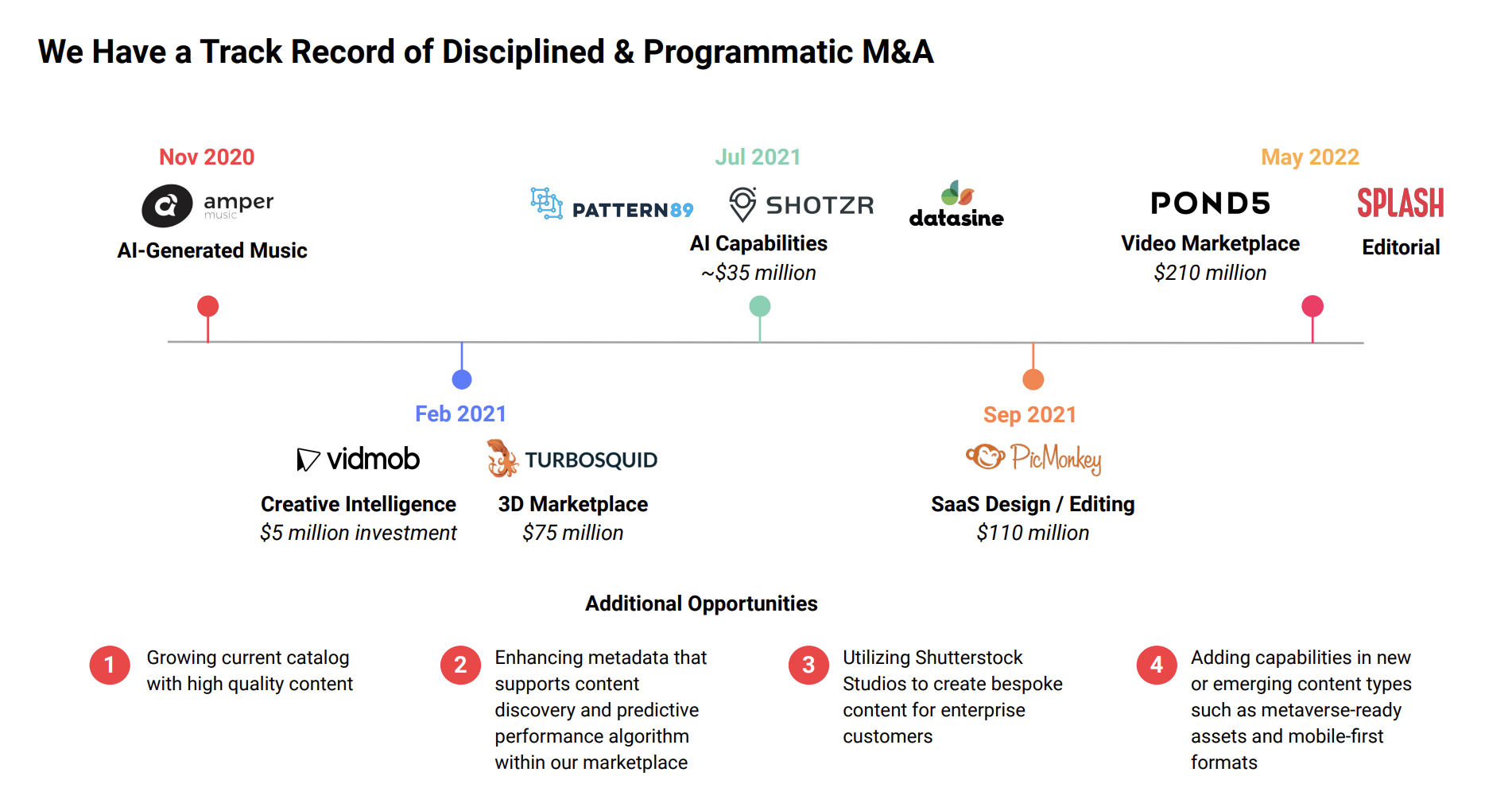

AcquisitionsIn recent years, the company has made numerous acquisitions, which appear to by synergistic, and add to the company’s library of licensable content.

Returns on Invested CapitalTruth be told, Shutterstock's returns have been somewhat underwhelming. Historically, their ROIC has struggled to reach double digits, but since 2020, it has crossed that threshold, with 2022 being their strongest year.

Given the company's aggressive acquisition strategy, this indicates that management’s efforts to integrate new assets and generate returns have only been moderately successful. And it seems these returns still fall short when compared to some of their competitors.

Take Adobe (ADBE), for example, which is likely Shutterstock's closest competitor. Adobe consistently achieves ROIC over 20%, with recent years pushing closer to 30%. This difference between these two companies is especially evident when comparing their total returns.

Shareholder Returns

Dividend PaymentsShutterstock's dividend is still relatively new, having been initiated in March 2020. Since then, the quarterly dividend has grown from $0.17 per share to $0.30 as of the most recent payment, reflecting a 16.8% compound annual growth rate (CAGR) over the past three years.

Excluding the TTM, the dividend seems well-covered, with the earnings payout ratio typically below 40% and the free cash flow (FCF) payout ratio hovering at a similar level.

Share BuybacksOver the last 10 years, shares outstanding has stayed relatively flat, with some issuances and some repurchases having occurred.

With that said, in June 2023, the Board of Directors approved a share repurchase program, authorizing the Company to purchase up to $100 million of its common stock.

Seeing as the stock is down 24% in 2024, now seems to be an opportune time to repurchase shares of the stock, and is a better use of capital now than it would’ve been this time last year.

Competitive Advantages

Size of Library + Network Effect

In a fragmented and competitive industry, Shutterstock’s competitive advantage is its scale and network effects between customers and contributors.

With the industry’s largest content library, Shutterstock is able to attract a global and diverse customer base representing creators and businesses of all sizes and from all major industries.

Their robust library of content and rich database continues to attract more customers and draw more contributors, which effectively creates a flywheel and enhances the company’s network effects and global reach.

The success of this flywheel and network effect should help to spur more growth in both the E-commerce and Enterprise sales channels, and should help the company maintain dominance in the fragmented and competitive industry in which they operate.

Risks

Artificial Intelligence Disruption

Certain platforms like those from OpenAI have proven that they're able to generate pretty high quality stock content, and as that becomes more developed, it could spell trouble for Shutterstock’s core business.

With that said, in a recent earnings call, the company’s CEO touched on this and said:

“Although customers are experimenting and creating these images in large quantities, they are not downloading such images and substituting them for original content.”

In addition, Shutterstock has been playing solid defense, and has actually taken the initiative to partner with some of these AI related companies like OpenAI and NVIDIA, so hopefully this should result in AI being less of a threat, and more of a companion for the company as time goes on.

Acquisition Risk

Over the last few years, Shutterstock has acquired numerous other companies which, so far, seem to have been accretive to the company. Most of them have been relatively small, have helped the company expand their content library in size, and have also helped introduce other formats like 3D models.

The potential risk to this, though, is if they start making bad acquisitions, especially if the acquisitions become larger in scale and price.

We’ve seen this happen with other companies (AT&T with DirecTV and WarnerMedia, and Altria Group with JUUL) and it’s proven to be pretty detrimental. So although Shutterstock’s track record has been pretty good so far, one bad deal could really turn that around.

Competition Risk

Shutterstock operates in a highly competitive, yet growing industry, and while the demand for this type of stock content should continue to climb as it has an extremely wide variety of applications, there’s also not a super high barrier to entry and there are a lot of other companies that provide stock content like MotionArray, Adobe, Epidemic Sound, Artlist.io, and Unsplash, just to name a few.

Valuation

Free Cash Flow Yield

The goal is to buy companies when the Free Cash Flow Yield (Free Cash Flow Per Share / Share Price) is at least 1% above the expected rate of inflation, which you can find here. This assumption reflects the notion that investors typically demand a premium above inflation to compensate for risk and to ensure a real return on their investment.

As of now, Shutterstock’s Free Cash Flow Yield stands at 2.23%, which tells us that the stock is likely overvalued. To meet a desired minimum Free Cash Flow Yield of 3.19% (at the time of writing), we would ideally want to buy Shutterstock at $23.82 per share, which is nearly $11 below the current price.

With that said, it’s worth noting that the current Free Cash Flow Yield is significantly below the company’s 5-year average, largely due to a sharp decline in Free Cash Flow Per Share in the TTM. If Shutterstock can revitalize its FCF per share, the Free Cash Flow Yield would improve big time.

Discounted Cash Flow (DCF)

Based on my own Discounted Cash Flow calculation, Shutterstock has an intrinsic value of $27.20 per share, making it about 21.3% overvalued compared to the current share price of $34.56.

Analyst Valuations

Morningstar: No rating

Alpha Spread: $42.35 (Worst Case) / $54.79 (Base Case) / $80.92 (Best Case)

Seeking Alpha: $53.25

Reflections

In a few sentences, explain the company like you were talking to a 9-year old.

Shutterstock is like a big online store where people can find and buy pictures, videos, music, and 3D models. The company connects people who make these things (creators) with those who need them (customers). If someone wants to use a picture or video, they can pay Shutterstock through a subscription or just buy what they need one at a time.

Why shouldn’t you invest in this company? (List at least one reason)

In my view, the biggest risk to Shutterstock is the growing competition from AI. As technology advances, it's becoming increasingly easy for anyone to generate high-quality photos and videos using platforms like ChatGPT, Adobe, and others.

This shift could potentially disrupt Shutterstock's business model, as more people turn to AI-generated content instead of purchasing stock images and videos.

If the stock market closed for five years, would you still feel comfortable owning this company?

It’s questionable.

At what price would you feel comfortable buying the stock at?

I found the Seeking Alpha and Alpha Spread valuations to be extremely optimistic. I’d rather buy the stock at a price closer to my DCF and Free Cash Flow Yield valuations—ideally somewhere in the mid-$20s.