Visa Inc. (V)

Last Updated: 8/25/2024

The content provided on this website, including any communications, posts, videos, social media interactions, and other materials, is for informational and educational purposes only. It should not be considered as financial or investment advice. Read our full disclaimer here.

Background

Company Overview

Visa operates as a global payments network, connecting financial institutions, merchants, and consumers. The company provides the technology and infrastructure that enables the extremely efficient transfer of funds between parties using its branded payment products, including credit and debit cards.

How Does The Company Make Money?

Transaction Fees: The Heart of Visa's RevenueVisa's revenue engine is fueled by transaction fees. The company, with its robust network capable of handling over 65,000 transactions per second, acts as the facilitator in every payment transaction. For each transaction involving a Visa card, the company collects fees from both the merchant and the respective financial institutions. This fee-based model has proven to be a lucrative source of income, given the sheer volume of transactions processed on Visa's network.

In the fiscal year 2023, Visa processed an incredible 276 billion payments and cash transactions, averaging 757 million transactions per day. This immense scale underscores the widespread adoption of Visa's payment solutions globally, contributing to the company's unbelievable financial performance.

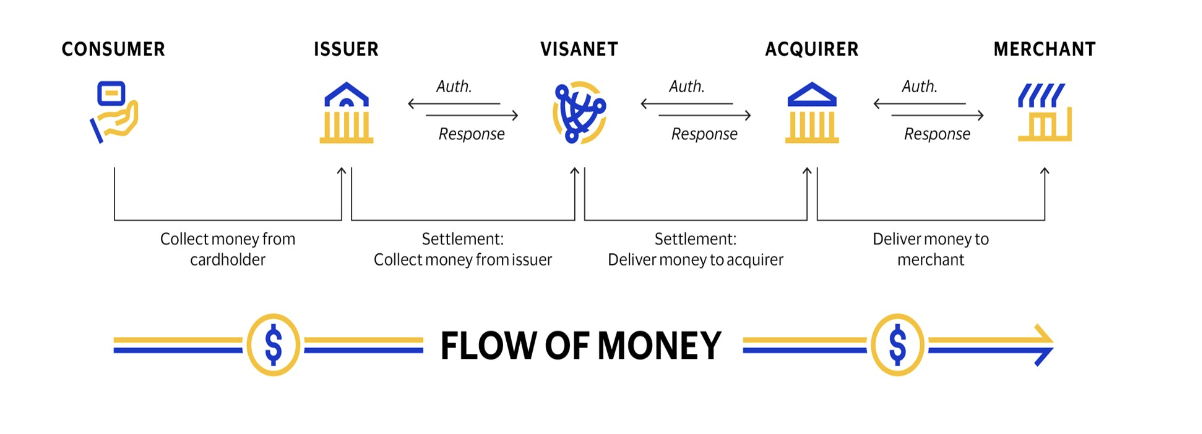

The Transaction Lifecycle: Visa’s “Four Party” ModelA typical Visa payment transaction involves a seamless orchestration of actions between four different parties. Consumers (1) make purchases from merchants (2) using Visa cards, and the transaction data is transmitted to an acquirer (3) for verification and processing. VisaNet, the backbone of Visa's network, facilitates the transmission of data between acquirers and issuers (4). The authorization process ensures the account holder's financial standing before finalizing the transaction. Subsequently, the acquirer pays the merchant, deducting the merchant discount rate (MDR), and Visa earns its share through interchange reimbursement fees.

In more simple terms:

Consumer: You, as a customer, buy something using your Visa card from a store.

Merchant: The store where you make the purchase.

Acquirer: The store's bank or a payment processor verifies that your payment is valid and processes it.

VisaNet & Issuers: Visa's technology (VisaNet) helps in sending info between the store's bank and your bank (the issuer) to make sure you have enough money. Your bank confirms if the purchase is okay based on your account balance.

If everything checks out, then the purchase is approved. The store gets paid by their bank, minus a fee (MDR), and Visa gets a cut too (interchange reimbursement fees). So, everyone involved gets a piece of the transaction.

Value-Added Services: Enhancing Client RelationshipsBeyond transaction fees, Visa distinguishes itself by providing value-added services to clients. These services encompass issuing solutions, acceptance solutions, risk and identity solutions, open banking, and advisory services. By offering a comprehensive suite of services, Visa enhances its relationships with clients, reinforcing its position as a trusted partner in the evolving landscape of financial transactions.

Global Money Movement: Visa's Technological ProwessVisa's revenue isn't confined to specific regions; the company earns by facilitating money movement across more than 200 countries and territories. Its innovative technologies enable seamless financial transactions between consumers, merchants, financial institutions, and government entities. This global reach underscores Visa's indispensable role in the international movement of funds.

One Important Note…It's important to note that Visa is not a financial institution. The company does not issue cards, extend credit, or set rates and fees for Visa products. Instead, it derives revenue from facilitating transactions and ensuring the smooth operation of its payments networks. The interchange reimbursement fees play a crucial role in balancing the costs and benefits for both account holders and merchants, contributing to the overall sustainability of Visa's ecosystem.

In conclusion, Visa's revenue model, rooted in transaction fees and complemented by value-added services, reflects the company's strategic positioning in the ever-evolving payments landscape. The scale, technological prowess, and commitment to providing value to clients make Visa a compelling investment in the dynamic world of finance.

Industry Overview

OverviewVisa operates in the transaction and payment processing services industry in the financials sector, which continues to see significant growth driven by the increasing shift towards digital payments, e-commerce, and other technological advances.

Key factors shaping the industry include:

Digital Transformation: The ongoing digitalization of the global economy has led to a surge in digital payments, boosting the demand for efficient and secure transaction processing services.

E-commerce Growth: The rise of e-commerce has intensified the need for reliable payment solutions, providing opportunities for companies in the industry to capitalize on increased online transactions.

Technological Innovation: The industry is characterized by rapid technological advancements in areas such as blockchain, contactless payments, and mobile wallets influencing the competitive landscape.

Regulatory Environment: Regulatory changes, especially in terms of data privacy and security, impact the operations and strategies of companies within the industry.

Visa Versus CompetitorsVisa:

Strengths:

Global Network: Visa has one of the largest global payment networks, enabling transactions in numerous countries and currencies.

Brand Recognition: The Visa brand is widely recognized and trusted, providing a huge competitive advantage.

Innovation: Visa has been at the forefront of technological innovation, investing in areas like contactless payments and blockchain.

Challenges:

Regulatory Risks: The industry is subject to various regulations, and changes in regulatory environments could impact Visa's operations.

Competition: Intense competition with other major players requires ongoing investment in technology and services.

Mastercard:

Strengths:

Global Presence: Similar to Visa, Mastercard has a strong global presence, facilitating transactions worldwide.

Challenges:

Dependency on Banks: Mastercard's revenue is closely tied to the financial institutions that issue its cards exclusively on the Mastercard network, making it susceptible to changes in their business.

American Express:

Strengths:

Premium Brand: American Express is known for its premium brand and focus on serving affluent customers.

Integrated Model: Unlike Visa and Mastercard, American Express often operates as both the card network and issuer.

Challenges:

Merchant Acceptance: American Express faces challenges in expanding merchant acceptance due to higher transaction fees. Because of this, it’s not accepted by as many merchants as Visa or Mastercard.

Capital One:

Strengths:

Diverse Financial Services: In addition to payment processing, Capital One offers a broad range of financial services, including banking and lending.

Challenges:

Niche in Payments: Capital One's primary focus is not payment processing, potentially limiting its scale compared to dedicated players like Visa.

Discover:

Strengths:

Integrated Model: Similar to American Express, Discover operates as both a card network and issuer.

Challenges:

Market Share: Similar to Capital One, Discover faces challenges in gaining market share compared to larger competitors like Visa and Mastercard.

PayPal:

Strengths:

Digital Payments Leadership: PayPal is a major player in digital payments, especially in the online and mobile space.

Diversification: Through acquisitions like Braintree and Venmo, PayPal has diversified its service offerings.

Challenges:

Dependency on Online Transactions: PayPal's business model heavily relies on online transactions, making it vulnerable to shifts in consumer behavior.

Financials

Growth

Visa's revenue has exhibited a steady upward trajectory over the years, driven by the global shift towards electronic payments and the increasing prevalence of digital transactions.

According to Snapstock, the compound annual growth rate of Visa’s revenue is about 11.3% for the last 10 years. Very impressive.

Their Net Income and Earnings Per Share (EPS) have done the same. In the same time period, the EPS growth CAGR is even higher at about 17.6%.

Profitability

Because Visa operates in a digital payment space where scalability allows for significant operating leverage, the company’s costs are very low, leaving it with one of the highest gross profit margins, operating margins, and net income margins I’ve ever seen.

Notably, the net income margin has expanded by approximately 12% over the last decade, underscoring Visa's growing profitability and operational efficiency over time.

Solvency

Visa currently has approximately $4.2 billion in net debt on their balance sheet, a figure that is easily manageable given the company's strong Free Cash Flow. With a Net Debt to Free Cash Flow ratio of just 0.21, Visa generates five times more Free Cash Flow each year than the Net Debt they have outstanding.

Management

Overview

Maximizing shareholder value is certainly important to the management team, as evidenced by the current dividend and share repurchase policies.

Management also appears to emphasize a culture of honesty, transparency, and collaboration throughout the company. In the letter from the CEO found in the company’s code of conducts presentation:

We value and encourage a transparent environment where people feel comfortable asking questions, respectfully disagreeing, and raising concerns. We hold each other accountable for doing what’s right and challenge each other to do better, every day. This is the collective responsibility that we all share and ensures that we are all doing our part to protect Visa’s outstanding reputation.

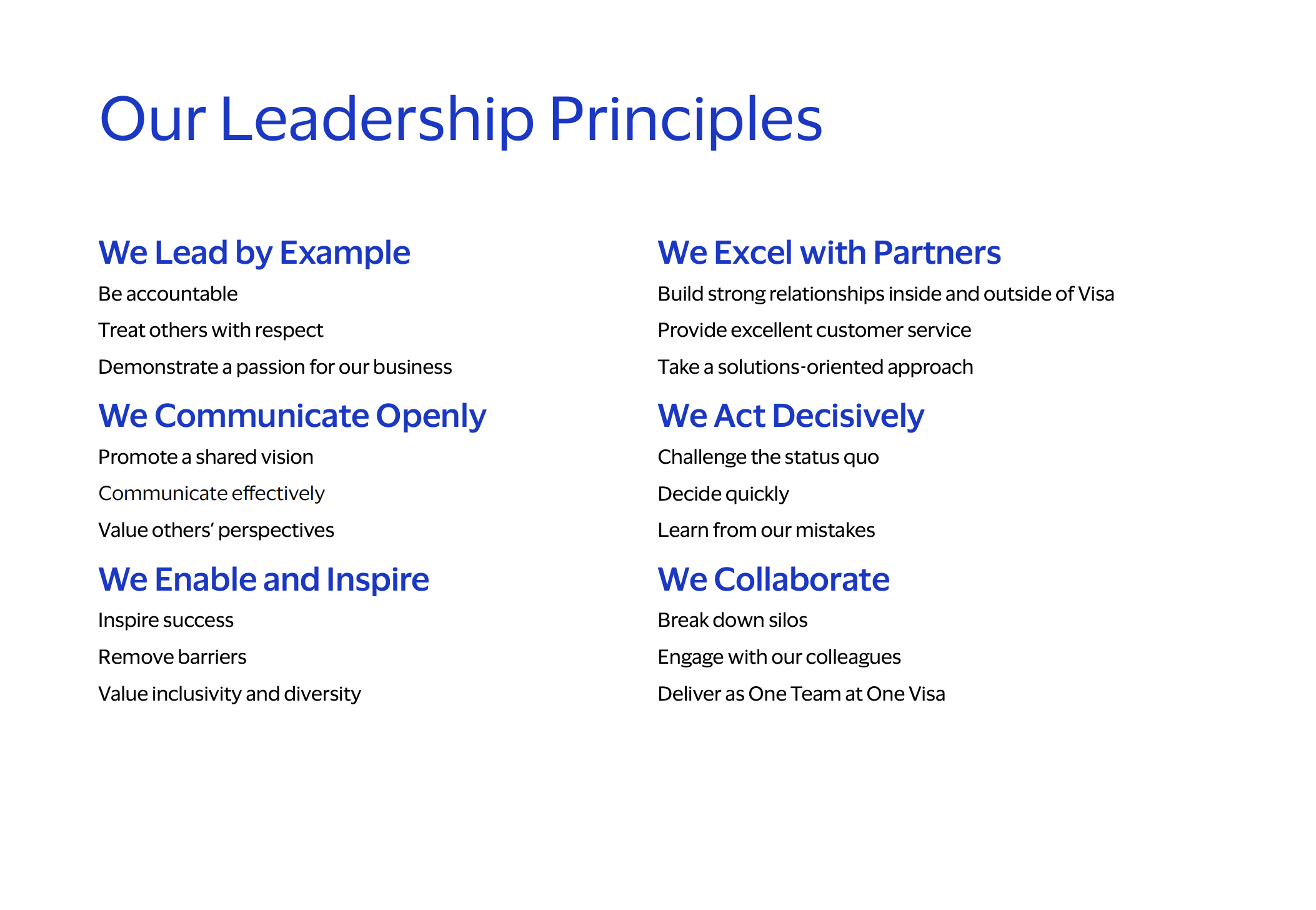

The ethical standard expected throughout the company is further outlined in the company’s leadership principles.

Capital Allocation

Reinvestment in the BusinessSince the company’s founding, Visa's commitment to innovation and technology in the payments industry has been evident. The company has consistently invested in new technologies and partnerships, and has made numerous strategic acquisitions — Tink (2021), Verifi (2019), and Payworks (2018) — to stay ahead in a rapidly evolving sector.

Reinvestment in the business is essential for Visa to maintain its competitive edge, especially in an industry where technological advancements can significantly impact market dynamics.

Shareholder Returns

Dividend PaymentsAt the time of writing, Visa has a pretty modest yield of about 0.8%. The payout ratio of 21.35% indicates that Visa is distributing a small portion of its earnings as dividends, leaving ample room for reinvestment in the business or share repurchases.

The impressive 5 year dividend growth rate of 16.27% and a consistent history of dividend growth for 15 years suggest a commitment to returning value to shareholders. In my opinion, this also signals financial stability and the company’s confidence in itself to generate sustainable cash flows.

Share BuybacksVisa's share buyback strategy has been notable. Over the period from 2014 to 2023, the company reduced its shares outstanding from 2.5 million to 2.047 million. This indicates a proactive approach to returning excess capital to shareholders and enhancing shareholder value.

Moreover, the announcement of a $25 billion share buyback program in October 2023 reinforces Visa's commitment to returning capital to shareholders. Share buybacks can be an effective way to signal that the management considers the company's stock to be undervalued.

With that said, the announcement and implementation of this share repurchase plan is coming at a time when the stock is trading at all-time high’s, which on the surface doesn’t scream undervalued, but may ultimately be. Time will tell from here, and I have personally been buying at current prices (around $260/share at the time of writing).

Competitive Advantages

Brand Recognition

When consumers think of making electronic payments, Visa is likely going to be the first name that comes to mind. This instant recognition and trust in the Visa brand creates a significant competitive advantage.

Visa has built a global reputation for reliability, security, and efficiency in facilitating transactions. This brand recognition not only attracts consumers but also builds trust among merchants and financial institutions. In the world of finance, trust is a precious commodity, and Visa's strong brand serves as a seal of approval for all parties involved in the payment ecosystem.

The ubiquity of the Visa logo on credit and debit cards worldwide further solidifies its position. This widespread presence contributes to a network effect, as more consumers and merchants choose to use Visa for its convenience and reliability. As a result, the brand becomes deeply ingrained in the payment habits of individuals and businesses alike.

Visa’s Network (VisaNet)

VisaNet benefits from strong network effects, which is a classic competitive advantage. As more merchants, banks, and consumers join the Visa network, the value of the network increases. This creates a flywheel effect where a larger network attracts even more participants, reinforcing Visa's dominance in the payments space.

The vast, global scale of VisaNet allows Visa to process an enormous volume of transactions efficiently. The cost per transaction decreases as the volume increases, giving Visa a cost advantage over smaller competitors.

This occurs because Visa has certain fixed costs associated with maintaining and operating its network, including technology development, network maintenance, and security measures. As the volume of transactions increases, these fixed costs are spread across a larger number of transactions. The more transactions processed, the lower the average fixed cost per transaction becomes.

Risks

Economic Risk / Consumer Spending Habits

Economic downturns can lead to reduced consumer spending as people tighten their belts during tough times. This decrease in spending could have a direct impact on Visa's transaction volumes and revenue.

Regulatory Risk

As global payment systems involve numerous jurisdictions, Visa must navigate diverse regulatory landscapes. Changes in laws and regulations related to payments, data protection, or financial services can impact Visa's operations.

Furthermore, given Visa's significant market share in the payments industry, there could be concerns about antitrust issues. Regulatory bodies may scrutinize its market dominance and could potentially impose restrictions or demand changes in business practices.

We saw this occur when Visa tried to acquire Plaid in 2020. The Department of Justice sued to block the deal, alleging that it would limit competition in the payments industry.

Alternative Payment Methods / Cryptocurrencies

One risk is the increasing popularity of alternative payment methods such as digital wallets, peer-to-peer payment platforms (like Venmo — owned by PayPal), and instant bank transfers. These methods may offer users lower fees and faster transaction times, potentially diverting some market share away from traditional card payments.

Additionally, the emergence and growing acceptance of cryptocurrencies pose a challenge to Visa’s business model. Cryptocurrencies operate on decentralized blockchain technology, often bypassing traditional financial intermediaries like Visa.

If cryptocurrencies become widely adopted as a means of transacting, they could undermine the need for traditional payment processors. This could impact Visa's transaction volumes and revenue streams.

With that said, though, Visa could choose to innovate and adapt its business model. This might involve exploring partnerships with fintech companies, investing in blockchain technology, or developing its own digital payment solutions. In fact, Visa has already taken steps toward developing something like this with their digital-ready token solutions.

Valuation

Free Cash Flow Yield

The goal is to buy companies when the Free Cash Flow Yield (Free Cash Flow Per Share / Share Price) is at least 1% above the expected rate of inflation, which you can find here. This assumption reflects the notion that investors typically demand a premium above inflation to compensate for risk and to ensure a real return on their investment.

At the time of writing, Visa’s Free Cash Flow Yield is 3.59%, which is about 2.3% higher than the company’s 5-year average and roughly 0.4% above the target yield.

This suggests that Visa is still an attractive buy, though not by a wide margin. It’s likely trading close to its fair value.

Discounted Cash Flow (DCF)

Based on my own Discounted Cash Flow calculation, Visa has an intrinsic value of $245 per share, making it about 8.2% overvalued compared to the current share price of $267.

Analyst Valuations

Morningstar: $272

Alpha Spread: $151.32 (Worst Case) / $187.60 (Base Case) / $250.60 (Best Case)

Seeking Alpha: $302

Reflections

In a few sentences, explain the company like you were talking to a 9-year old.

Basically, Visa is the referee in a game between banks, businesses, and customers. When customers buy something from a business, Visa checks with the customer’s bank to make sure they have enough money to make the purchase. If it all checks out, and the customer has enough money, then Visa helps transfer the money from the customer’s bank to the business’s bank.

Why shouldn’t you invest in this company? (List at least one reason)

In my opinion, the biggest reason not to invest in the business would be potential disruption and mass adoption of some alternative payment method that completely eliminates the need for a company like Visa. This could include things like digital wallets, peer-to-peer payment apps, cryptocurrencies, etc.

If the world at large opts for payment methods that can bypass Visa’s network, and Visa isn’t able to adapt to that, it will, in effect, render Visa obsolete.

If the stock market closed for five years, would you still feel comfortable owning this company?

Without a doubt.

At what price would you feel comfortable buying the stock at?

I’ve slowly acquiring shares between $260-270, which may actually be overvalued based on the numerous far values shared in the “Valuation” section.

Resources

Videos

Podcasts

Other