Is SCHD Still the Holy Grail of ETFS?

SCHD's performance as of late has been underwhelming, to say the least, leaving this burning question on the minds of many investors: Is SCHD still the Holy Grail of ETFs?

It's true that SCHD has experienced a dip in performance, with a year-to-date decline of nearly 7.5%. Furthermore, it has officially underperformed the S&P 500 on a 3 and 5-year period, leaving some investors questioning their long-term position in the fund.

However, l think it's best not to throw the baby out with the bath water. I think SCHD is still one of the best long-term choices for dividend investors, and here are a few reasons why:

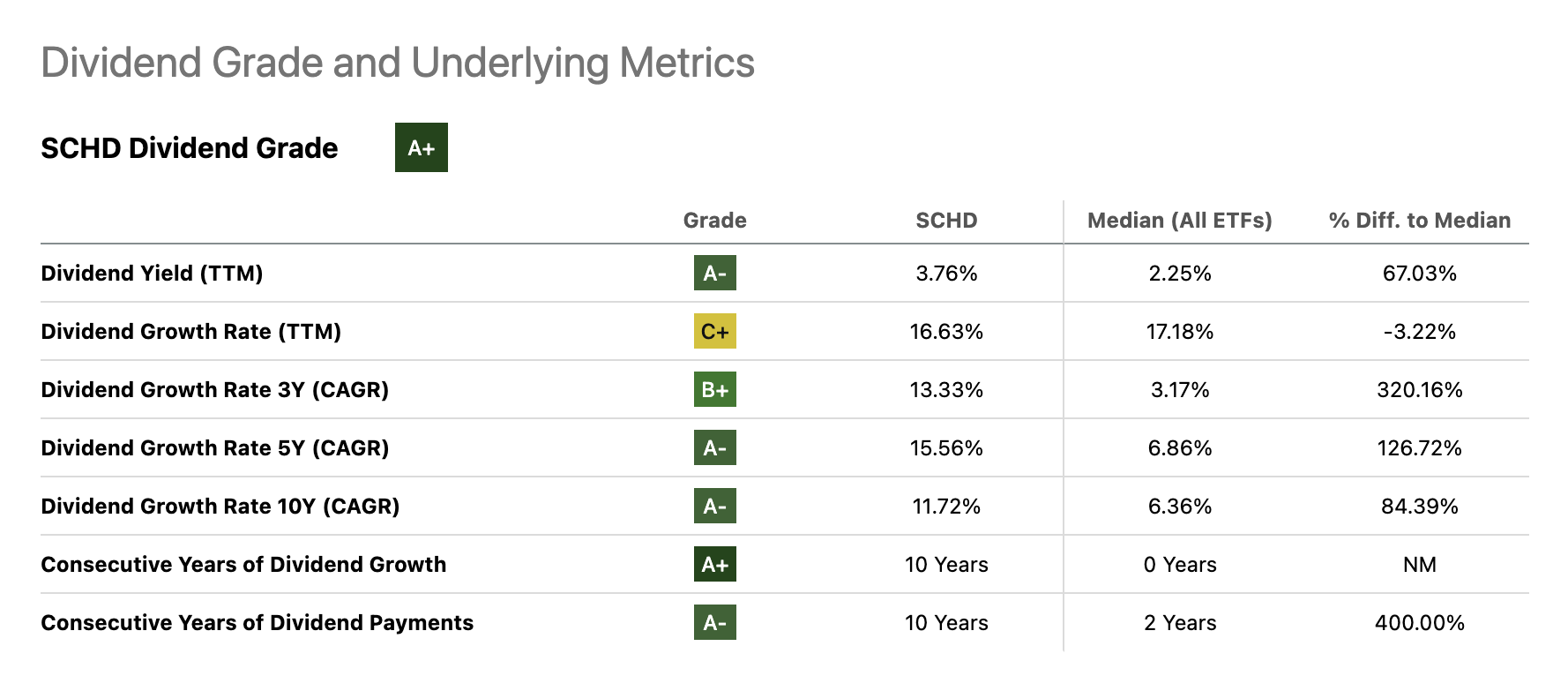

Delicious Dividend Stats: Share price performance aside, SCHD has consistently paid an attractive, growing dividend over the years. The fund focuses on high-quality dividend-paying companies with a track record of paying their dividends. With SCHD, you can still expect a competitive, growing income stream, even when the share price is in a slump.

Source: Seeking Alpha

DIVIDEND INVESTING DEMOCRATIZED

Join thousands of savvy investors in the pursuit of early retirement. Get Retire With Ryne delivered straight to your inbox every week as you build your perpetually growing, cash-flowing dividend stock portfolio.

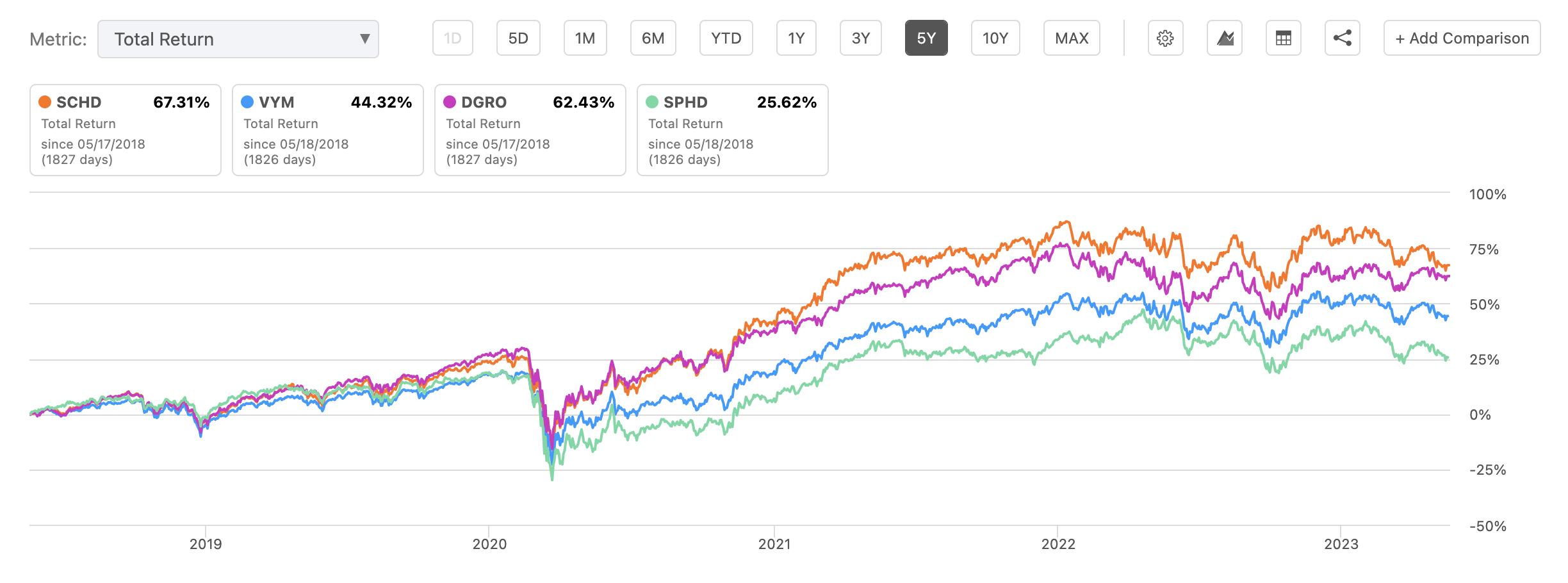

Long-Term Performance: While recent performance may not be sending the share price to the moon, it's important to zoom out across a longer period of time to really get a sense for what it's done. Over the past five years, SCHD has consistently outperformed many of its peers in the dividend ETF space.

Obviously, past performance isn't a guarantee of future results, and things may change for SCHD as time goes on, but its performance so far is all we have to work with.

Source: Seeking Alpha

Diversification: SCHD offers investors a well-diversified portfolio of over 100 dividend stocks across various sectors and industries. To be eligible to even be in the fund, each company must have sustained at least 10 years of consecutive dividend payments.

This diversification and emphasis on the quality and sustainability of dividends helps to mitigate risks on multiple levels, and should provide stability and consistent cash-flow even in turbulent markets.

Source: Seeking Alpha

Having said all of this, it's important to remember that dividend investing is not solely about chasing the highest yield or short-term gains. It's about building a resilient portfolio that generates reliable income and increases wealth over time.

I still think SCHD's investment philosophy aligns with these principles, and I'll tell you more about my future plans with this fund here in my recent sit-down with the one and only Professor G.

With that said, I want to hear from you. Have you been buying any more shares of SCHD during the downturn? Write to me here and let me know.

Disclaimer: This page contains some affiliate links that might just lead you to the promised land of awesomeness (or at least some cool products). We may receive commissions for purchases made through links in this post. It's nothing fancy, but it certainly does the job!